Preparing for the 2013 Housing Market

- Housing Prices rose during 2012, the first time since 2006.

- Mortgage Rates are at historic lows.

- Buy or Rent? Make sure you can afford your 2013 housing.

Home Affordability in 2013: Which Direction Will Home Prices Go?

Housing prices rose 2012. After hitting the lowest levels since 2007, in January 2012, housing prices started to increase.

Predicting future markets is impossible. We don't know where exactly home prices are headed. Markets today are in a huge state of uncertainty, given the tension over factors such as the budget crisis, fiscal cliff, taxes, and US Debt Ceiling crisis. Also, home values area are affected by regional and local differences.

However, having said that, we can safely say that anyone looking to buy a home should take a number of basic factors into consideration, including these:

- Mortgage Rates

- Housing Prices

- Consumer Creditworthiness

Quick Tip #1

The HARP 2 program is helping underwater borrowers refinance loans (Fannie Mae and Freddie Mac loans delivered before June 1, 2009). But, there are over 7 million borrowers who are not eligible for the HARP program. With an increase in housing prices, check into refinancing now.

Mortgage Rates: 41% Say Mortgage Rates Going Up in 2013

As mortgage rates go up, housing affordability goes down. There are many macro-economic factors that will influence mortgage rates, including the fiscal crisis, the Federal Reserve’s monetary policy (including its plans for buying Mortgage Backed Securities), new mortgage regulations (including the CFPB’s Qualified loan rule), and plain old supply and demand.

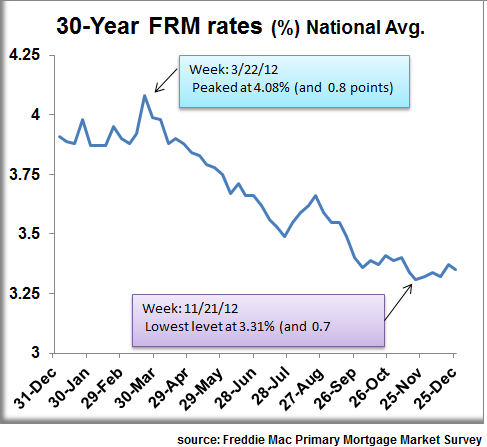

One thing that is quite clear, however, is that mortgage rates have hit historical lows, which has caused a boom in refinancing. The most popular loans today are the 30-year Fixed Rate Mortgage (FRM) and the 15-year FRM. According to Freddie Mac’s Primary Market Mortgage Survey (PMMS), average mortgage rates for January 3, 2013 were:

- 30-year FRM: 3.34% (with loan fees of 0.7%)

- 15-year FRM: 2.34% (with loan fees of 0.6%)

The chart below shows how mortgage rates changed during 2012 (based on Freddie Mac’s Primary Mortgage Market Survey), reaching record lows.

Quick Tip #2

Mortgage rates dropped from over 6.5% in 2006 to their current lows. However, when you're shopping for a mortgage, pay attention to more than the rate. Always check your mortgage fees, too. Stay abreast of today’s mortgage rates by bookmarking the Bills.com mortgage rate page. Rates are updated multiple times daily and you can customize the table to find out applicable rates for your exact situation and needs.

According to Fannie Mae’s November 2012’s Housing Survey 41% of the households believe that mortgage rates are going to increase. Only 9% thought rates would drop and 45% thought that mortgage rates would remain the same. The chart below illustrates that many more consumers believe that mortgage rates will increase during 2013:

Quick Tip #3

Refinances are at all time highs, representing over 80% of conventional loans for most of 2012. Take advantage of low mortgage rates and get a mortgage quote.

Housing Market: Good time to Sell and Buy

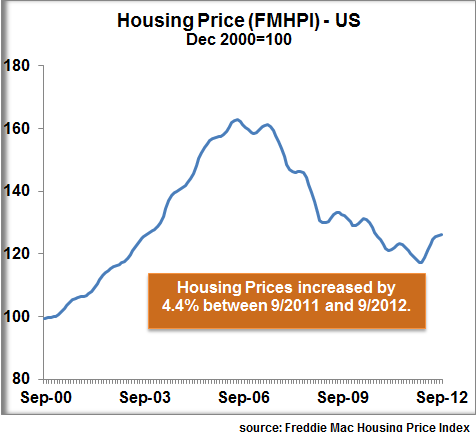

Currently there are signs of growing consumer confidence and an improving housing market. Based on Freddie Mac’s Housing Price Index (for all of the US), housing prices hit a peak in July 2006. Prices then dropped to their lowest level in January-February 2012. Housing prices have subsequently risen by more than 7% since January 2012 to September 2012. The yearly change between September 2011 and September 2012 was 4.4%, as shown in the chart below:

Fannie Mae’s November 2012 Housing Survey included these results

- Good time to Sell: 23% of respondents say it is a good time to sell, a 5 percentage point increase over last month, and the highest level since the survey’s inception.

- Good time to Buy: About 72% of the respondents felt that it was a good time to buy. (Steady)

- Home Prices: About 37% believe that home prices will increase (a slight increase), while 14% believe that home prices will decrease (an increase of about 4 percentage points).

Quick Tip #4

Keep track of the value of your home. An increased value may help you get refinance at a better rate. Get a mortgage quote for a FHA, VA, conventional or HARP loan from a Bills.com mortgage provider.

Trulia published a cool infographic listing original reasons for a bullish housing market, including these statistics:

- Increase in asking prices on for sale home - up 3.8% for year (Nov 12, source Trulia)

- Increase in Construction Starts : Up 42% for year (Oct. 12, source Census)

- Increase in Existing Home Sales - Up 11% for year (Oct. 12, source NAR)

- Decrease in delinquency + foreclosures: Down 10% for Year (Oct 12, source LPS First Look)

- 31% of today’s renters want to buy a home in the next two years. This is up from 22% in Jan 2011 and 28% in May 2012.

Quick Tip #5

Looking to buy a home? Get a mortgage quote and preapproval from a Bills.com mortgage provider.

Mortgage Affordability: Your Credit Worthiness

An improved housing market will help put more houses on the market. Rising prices and higher mortgage rates means that you may be able to afford a less costly home. Your ability to close a deal will depend on your ability to afford the mortgage and housing payments and come up with a sufficient down payment.

Here are the main things to be aware of:

- Credit Score: A credit score over 620 might be a necessary condition. Although today you can get a FHA loan with a credit score of 580 (and still get 96.5% financing), this might be a thing of the past. In any case most borrowers have much higher credit scores.

- Debt-to-Income Ratio: A conventional loan requires a DTI under 45% and FHA loans restrict the DTI to 43%. However, to place yourself in a solid financial position, aim for a DTI of around 36%. Aim to pay off your credit card debt and maintain a low credit utilization level.

- Down-payment: Try to save money for your down-payment. Conventional loans, without mortgage insurance, are available up to 80% of the value of your property. You can get a FHA loan up to 96.5% financing or a conventional loan generally up to 90-95% financing, but you will pay more for mortgage insurance.

Bottom Line: Stay Tuned and Shop Around

As of early 2013 the signs are that housing prices are on the rise (although modestly so) and that mortgage rates will begin to rise. Given todays low mortgage rates and home prices, it is an opportune time to check out the housing market in 2013.

Make sure that you prepare yourself to qualify for a mortgage with the best rates possible.

Quick Tip #6

Check out Bills.com mortgage rate table and get a mortgage quote from a Bills.com mortgage provider.