HARP 2 Mortgage - Updates on HARP Refinance

- The HARP 2 mortgage has been much more successful since March 2012.

- However, there are still barriers for many borrowers, due to strict lender guidelines.

- For the best deal, shop for a harp mortgage.

HARP 2 Mortgage: Be Informed!

April 11, 2013 - Update:

The FHFA announced the extension of the HARP 2 mortgage for two more years. The new expiration date is December 31, 2015. More than 2.2. million borrowers refinanced their mortgages under the HARP program since 2009 and more than 1.2 million since the inception of the HARP 2 program in Nov. 2011.

In their April 11 news release the FHFA also announced that they will be "launching a nationwide campaign to inform homeowners about HARP", which will include educational material for consumers. This coincides with Fannie Mae's announcement that they will be updating Lender solicitation material.

The FHFA did not make any other changes in the HARP refinance program. The FHFA expressed their hope that a substantial number of borrowers would benefit from the low interest rates. With the lack of progress on the Boxer-Menenedez 2013 Refinance Bill and no HARP 3 legislation in the works.

Additional HARP Updates from April 2013

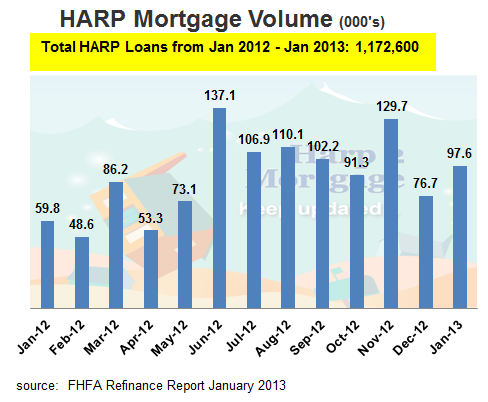

HARP 2.0 in full swing: January 2013 volume was back up with a total of about 98,000 loans. That makes more than 1.2 million loans since January 2012. (See the chart below for the month by month progress).

HARP 2.0 and High LTV: HARP 2 eliminated LTV caps, although lenders do apply overlays. In January 2013 High LTV (over 125%) remained steady, at about 25% of the total HARP loans.

HARP 2.0 - Shop Around: The HARP 2 changes included more lenient credit requirements for borrowers and unlimited LTV. However, many lenders have adopted stricter rules, making it difficult for many borrowers to take advantage of the HARP program. That means you have to shop around for an approval and good terms.

HARP 3.0 - Not There Yet: Oregan started a pilot program of Sen. Merkley's Rebuilding American Homeownership. Could this be a start of HARP 3? Also, Boxer-Menendez introduced, for the third time, their HARP 2 refinance bill, aimed at helping eligible HARP borrowers. Will three be the lucky number?

Not all lenders offer the same terms for a HARP 2 mortgage.

Bills.com can help you find a HARP loan. With rates at historic lows, it pays to apply now.

New Expiration Date - HARP Program Extended:

The FHFA announced on April 11, 2013 that they will be extending the HARP program for two additional years. The new expiration date will be December 31, 2015.

If you are not eligible for a HARP loan, due to a late payment, or low credit score, then make a plan to improve your situation and meet the expanded deadline.

Are you eligible for HARP?

Bills.com can help you find a HARP loan. With rates at historic lows, it pays to apply now.

Bills.com offers you updated information regarding the HARP 2 program,including eligibility requirements and additional lender overlays. If you are underwater and want to refinance your loan then get updates about:

- The HARP Basics - Goals and Eligibility Requirements

- HARP 2 lenders and Underwriting Systems

- Qualifying for a HARP 2 loan - Lender Overlays Ahead!

- Beyond HARP 2 - HARP 3?

Are you eligible for HARP?

Bills.com can help you find a HARP loan. With rates at historic lows, it pays to apply now.

The HARP 2.0 program - The Program Basics

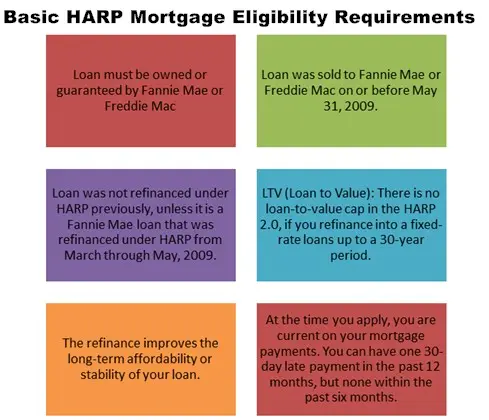

One of the cornerstones of the Making Home Affordable(MHA) 2009 program was the HARP (The Home Affordable Refinance Program) program, which allows owners of underwater homes to refinance to today's low HARP interest rates. Refinancing is typically not possible for owners with little or negative equity. The key requirement for HARP eligibility is that Fannie Mae or Freddie Mac must own the home loans.

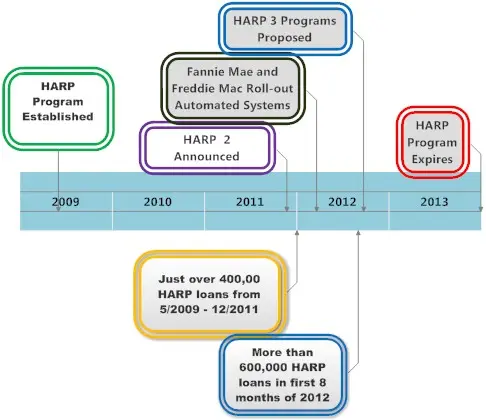

The HARP program has come a long way since its inception in 2009 as part of the MHA program. The timeline below shows key milestones in the program. Note that the amount of loans for the first 8 months of 2012 was larger than the previous 2 ½ years. This was greatly due to the roll-out of the automated loan programs in March 2012.

Here is a brief timeline of the HARP program, showing key events and amounts of loan given out since 2009.

Quick Tip:

Take advantage of today's historically low interest rates and get a HARP mortgage quote from a Bills.com mortgage provider.

Basic HARP Requirements and Eligibility

Not every upside-down home qualifies for HARP 2.0. Here is a summary of the basic requirements:

HARP Refinance Loans: Which Lender - Original Lender/Current Servicer or New Lender

One important distinction in the HARP program is who originates your loan and how they underwrite it. This can be broken down as follows:

Original Lender/Current servicer: Manual underwriting system or Automated Underwriting System (AUS).

New Lender: AUS only. The AUS for Fannie Mae is the DU Desktop, and for Freddie Mac the LP Loan Prospector. One of the goals of the HARP 2.0 changes was to increase lender participation in the program by making it less risky for lenders to refinance high LTV loans. Unfortunately, the original lenders have an advantage. The big banks, which originate and service many loans, have been selective in their HARP offerings and often charge higher rates.

Only the original lender (who is also your current servicer) can use a manual underwritten system, which has the most lenient requirements. However, most borrowers do not need that type of qualification and can get better rates by shopping around.

Quick tip

Shop around to find the right lender and the best terms. Get a HARP mortgage quote from a Bills.com mortgage provider.

Qualifying for a HARP 2 loan - Lender Overlays Ahead!

Like any mortgage loan, you have to meet basic underwriting rule to qualify for a loan. The good news is that the HARP 2.0 program has many lenient credit, income and property requirements. It is fairly easily to qualify for a HARP loan if you have an underwater Fannie Mae or Freddie Mac loan.

The bad news is that many lenders have added their own more stringent requirements or overlays. If you want to get the best rates, learn about some of the requirements and lender overlays, and shop around.

Quick Tip

Shop around for the lender that can offer you the best terms. Get a HARP mortgage quote from a Bills.com mortgage provider.

Here is a quick guide to the lender requirements (not using the manual underwriting system) based on major criteria:

| HARP Loan Requirements | Automated Underwritten and Lenders Guidelines |

|---|---|

| Income Requirements | Loan applications that go through the automated DU system must meet the basic DU 45% maximum debt-to-income requirements. |

| Credit Score Requirements | Although there is no minimum credit score required, most lenders will not go below a FICO score of 620. |

| Mortgage Payment History | Although you are allowed one late payment (30+) in the last year, and none in the last 6 months, some lenders will not approve your application if you have a delinquency in the last year. |

| Foreclosure and Bankruptcy | There is no loosening of the rule for foreclosure and bankruptcy. You will have to wait the regular required periods, between 2-4 years for bankruptcies. |

| Occupancy | HARP loans are no longer restricted only to owner-occupants. You can now use HARP to refinance your second home or investment property. Many lenders have stricter requirements, so you made need to shop around. |

| Mortgage Insurance | If you have problems with transferring mortgage insurance to your HARP 2 loan, then speak with your mortgage insurance company and shop around with other lenders. |

Quick tip

If you are eligible for a HARP loan, then shop around. Lenders have different underwriting requirements and rates. Start by getting a mortgage quote from a Bills.com mortgage provider.

Beyond HARP 2 - HARP 3? More HARP Updates!

HARP 2.0 has helped many underwater homeowners refinance into better interest rates and lower monthly payments. However, many borrowers have been left out for various reasons including:

- Not meeting technical requirement (High DTI)

- Not meeting Lender’s stricter overlays (High LTV or Low Credit Score)

There are various proposals for a HARP 3 program some of which are designed to help eligible HARP 2 borrowers get a loan, such as the Menendez-Boxer legislation. Other proposals would expand the playing field, such as the Obama #MyRefi proposal and Sen. Merkley's Rebuilding American Homeownership Program for Underwater Borrowers.

It still remains to be seen if any of the new programs will pass through congress. Keep up with the events by following Bills.com HARP 2 Updates, HARP 3 pages and other related articles.

Quick tip

If you have an underwater loan then Shop around and get a mortgage quote from a Bills.com mortgage provider. Shopping will help you find a lender that has less strict overlays and will fund your 150% or 200% LTV loan.

Suggestions on where I can go from here?