Refinance Now, or Wait?

Many homeowners with a mortgage ask themselves: Should I refinance now or wait? Maybe interest rates will drop and you can save even more, but there are good chances that mortgage rates will rise during 2017.

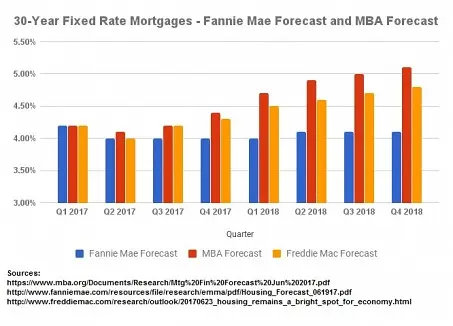

Although rising interest rates decreases the amount of money you can save, today’s rates are still low enough to make refinancing now an attractive option. No one can accurately predict future interest rates. In fact, the chart below illustrates the different forecasts between the Mortgage Bankers Association, Freddie Mac, and Fannie Mae:

Get a Mortgage Quote

As important as a forecast can be to help make economic decisions, the important factor for any household is what are the rates today. Looking to refinance now? Get a mortgage quote now from a Bills.com mortgage provider.

Good Reasons to Refinance Now

Depending on the reasons that you wish to refinance, you can choose between a long-term 30-year FRM or a shorter-term 15-year FRM. With today’s low mortgage rates, there are a few obvious reasons to refinance now:

- Save money - Cut your interest costs

- Build Equity in your home - Pay off the mortgage quicker

- Get a more affordable monthly payment

- Get out of mortgage insurance

Refinance Now: Lower Your monthly payment

If you decided to refinance back into a 30-year mortgage, then you can lower your monthly payment and free up cash for other purposes. This can help you save money by avoiding high interest fees on your credit cards. Or, you can start building up your emergency fund, retirement account, or investment account.

Since your mortgage bill is a major monthly expense, this is an effective method to reduce your monthly payments. You will increase the amount of time you pay back your loan and probably increase your total scheduled interest payments. However, the new loan may also save you money. Since most borrowers pay back their loan early there are potentially big savings.

Refinance Now: Build Equity and Save Money

One of the most effective ways to refinance and save money is to take a shorter-term mortgage. Keep in mind that you have been paying your mortgage for a number of years. By keeping the new loan at a lower term, you will pay off your loan quicker and increase the amount of money you save.

Also, 15-year mortgage rates are much lower than 30-year rates. According to Freddie Mac’s PMMS, over the five year period from May 2012 to April 2017 the 15-year FRM rate was 0.8% lower than the 30-year FRM.

Refinance Now: Better Credit Score? Easier to Qualify

Maybe your credit score was damage? Or perhaps your debt to income ratio (DTI) improved?

If your financial situation has improved either due to improved income, or less monthly debt payments, then you might now qualify for a refinance mortgage loan.

The good news for many borrowers is that lenders are planning on easing their credit requirements. If you didn’t qualify before, then consider applying for a mortgage refinance loan.

Refinance Now: Get Rid of Mortgage Insurance

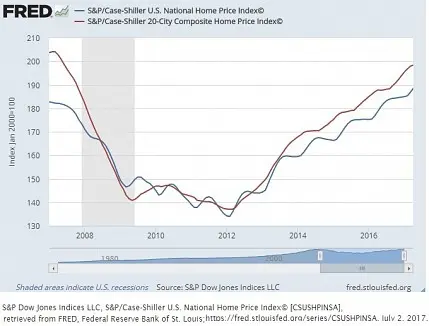

If you were underwater and could not refinance your loan, along with millions of American households, then the rise in property values means that you could possibly refinance your mortgage.

Home prices have greatly increased. Check out the graph below which shows the Case-Shiller HPI for the US, and 20 major cities. Home prices have basically recovered from their losses in the 2008 Great Recession.

In addition, anyone who recently took out a loan with private mortgage insurance, or a FHA loan, which requires mortgage insurance, should now check the value of their home and see if they can now refinance their home without mortgage insurance and save money each month.

Mortgage Rates are Low

This is a great time to refinance into low fixed interest rates. Get a mortgage quote.

Bills Action Plan - Refinance Now

Are you ready to refinance now? Then, shop around to find the best rate and terms. Keep in mind that mortgage loans generally have substantial upfront costs, some of them are lender fees and some third-party fees.

In order to get the best deal:

- Carefully compare all your options, including no-cost mortgage loans, some of which include a higher balance, because the lender rolls the fees into your loan.

- Prepare yourself for refinancing, so that you are a borrower to whom lenders will offer the best terms. Improve your credit score. Lower your debt-to-income ratio.

- Pay down your mortgage if possible. Many borrowers are doing this to lower their loan-to-value below 80%, and saving money by avoiding mortgage insurance.

- Check out Bills.com Refinance calculator.