Banking: How Do Banks Work?

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- Banking is an industry built around paying interest to depositors for the use of their money and lending that money to borrowers at a higher rate.

- Banks can be brick-and-mortar institutions or exist entirely online.

- Banks make it safer for people and businesses to save, borrow and spend money.

- Start your FREE debt assessment

Table of Contents

Banking is such a common part of everyday life you may not give it much thought. Some examples:

- Your employer deposits your paychecks into a bank automatically.

- You swipe a card to pay for your groceries.

- Your bank keeps your savings and pays you interest.

- You use loans to help you afford your home and your car.

These are just a few of the roles banking plays in the day-to-day routines of most Americans. Banking makes things so convenient you don’t have to stop to think about how it all works.

And that’s the problem. If people knew a little more about how banks work, they could save a lot of money.

This article covers some basics about banking that could make you a more informed consumer. By looking at questions like how do banks work and how do banks make money, you can gain some insights into how to get a better deal from a bank.

What Is a Bank?

A bank is a financial institution subject to federal and often state laws. Those laws cover everything from how banks keep people’s money safe to how much they can charge their customers.

A bank can be a national organization with thousands of branches around the country or a small local institution that few people outside of your town have ever heard of. Increasingly, a bank may exist purely online.

The next section of this article outlines some of the products banks might offer, but banking largely boils down to two functions:

- Taking in and safeguarding deposits

- Lending money

How banks do those things, and specifically how they make money from those activities, is the key to whether bank products are good deals for their customers.

Common Banking Products

Here are some major types of consumer products that might be offered by banks:

- Savings accounts. These are accounts that keep customer deposits secure and earn interest. They are designed for building savings over time, not for day-to-day transactions. In addition to traditional savings accounts, money market accounts and certificates of deposit (CDs) fall into this category.

- Checking accounts. These are accounts designed for frequent transactions like paying bills. Checking accounts might pay interest, but it’s usually less than you’d earn in a savings account.

- Credit cards. These give you instant access to a line of credit. You pay interest based on how much you borrow unless you pay off what you owe every month. Credit cards may also charge fees for a variety of activities.

- Loans. In addition to providing instant credit through credit cards, banks also supply longer-term loans that are designed to be paid back over a set schedule. You pay interest for what you owe during the loan’s term, and there may be fees for setting the loan up. Loans may include home mortgages, car loans, student loans, or personal loans.

- Investment products. This may include things like funds or managed accounts designed to grow through investment in securities. Banks typically charge fees based on a percentage of the amount of money they manage.

Besides consumer products, there is also a wide range of services that banks may provide to businesses.

How Safe Are Banks?

Banks are designed to keep your money safe in two ways:

- Banking regulations limit how much risk they can take with customer deposits

- Federal insurance protects deposits in case a bank fails

While these two types of safeguards are very effective, you should understand that there are limits.

Even if a bank is federally insured, not all the products it provides may be covered by that insurance. Deposit insurance typically applies to savings, checking, money market, and CD accounts at participating institutions.

Finally, even if you are in a federally-insured type of account, that insurance is limited to $250,000 per depositor at any one institution.

Banks vs. Credit Unions

It’s easy to confuse banks and credit unions because they have many similarities.

Both banks and credit unions offer similar products, centered on the two general functions of safeguarding deposits and making loans.

Banks and credit unions are also both covered by federal deposit insurance. Banks are insured by the Federal Deposit Insurance Corporation (FDIC). Credit Unions are insured by the National Credit Union Association (NCUA).

Both FDIC and NCUA insurance apply up to the same limit of $250,000 per depositor at any one institution.

So those are some similarities. What are the differences between banks and credit unions?

To open an account at a credit union, you have to be a credit union member. Membership eligibility may be based on geography, military experience, religious group, or employment.

In contrast, opening an account at a bank is not restricted to specific groups.

Credit unions are owned by their members and are not run to turn a profit beyond what’s necessary for their efficient operation. This can allow them to offer more competitive products in some cases.

On the other hand, banks are not bound by membership restrictions and thus may be more accessible to all.

As a practical matter, there is a lot of overlap between what banks and credit unions can do for you. Depending on your needs, it may be good to consider both institutions to give yourself the widest possible choice.

How Do Banks Make Money?

To be an educated consumer, it helps to know how the people you do business with make money. That allows you to see how products and services will cost you, so you can make comparisons to find the best deal.

Banking revenue comes from two major sources: fees and interest rates.

Fees

Banks may charge a monthly or annual fee for having a certain type of account. They also may charge additional fees for certain types of activities in those accounts.

Don’t overlook those additional fees because they can be a major part of a bank’s revenues. That means they may be what costs you the most for a particular type of account.

For example, the Consumer Financial Protection Bureau (CFPB) estimates that overdraft and non-sufficient funds (NSF) fees totaled over $15 billion in 2019. The CFPB found these fees generally exceed $30 per occurrence. Worse, if you have multiple transactions while your account is overdrafted, you could be charged several of those fees at once.

Thus, overdrafting your checking account by a few dollars could cost you over a hundred dollars in fees.

As another example, the CFPB found that credit card late fees cost consumers $14 billion in 2019. This represented over half the fee revenue credit cards earned from their customers.

Thus, even if you pick a credit card with no monthly fees, you could still pay a lot of money in fees depending on how you use the card.

So, whether it’s a deposit account or a credit card, always read the full fee schedule for any banking product before you sign up.

Interest rates

Banks also earn money by charging interest on amounts consumers borrow. This includes credit card balances as well as mortgages and other loans.

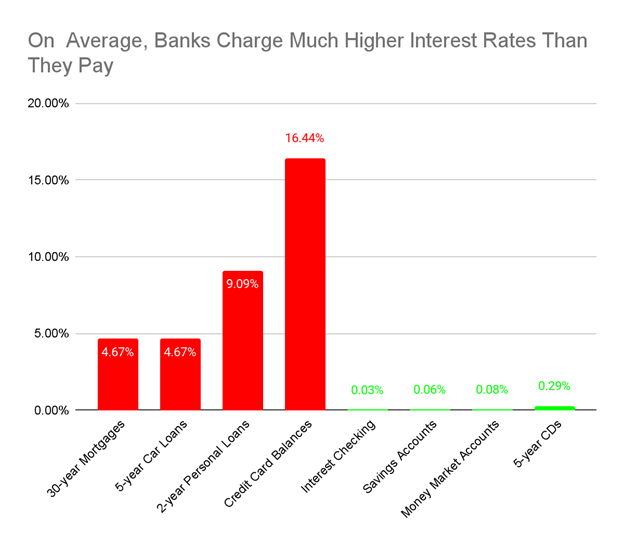

Of course, besides charging interest on borrowed money, banks also pay interest to customers on deposits. However, a key to how banks make money is that they charge more interest for the money you borrow than they pay for the money you deposit with them.

The chart below shows average interest rates on several different types of banking products. The ones in red are products that charge you interest. The ones in green are products that pay you interest. As you can see, the interest rates you pay are much higher – so much so that the ones in green are hardly visible!

The chart was based on the latest available data as of early April 2022 from Freddie Mac, the Federal Reserve, and the FDIC.

As explained below, both fees and interest rates should factor heavily in your decision when choosing a bank.

Choosing a Bank

Based on this background of how banks operate, the following are some tips on choosing a bank.

Focus product by product

Each bank has different strengths and weaknesses. Since you may have a variety of banking needs, don’t lock yourself into having all your accounts at one bank.

For example, one bank might have the highest-yielding CDs. Another bank might offer the best low-interest, no-fee credit card.

In that case, you’d be better off getting these products at different banks. After all, with so much banking being done online these days, it really isn’t much more convenient to do all your banking in one place.

Choosing the best product regardless of where your other accounts are located frees you up to find the best deal for each type of account.

Consider both fees and interest

As described earlier, banks make money on both fees and interest charges. Be sure to take both into account when choosing a bank.

Checking accounts are a great example. Some checking accounts boast that they pay interest, but pretty much all checking account interest rates are very low. If an account will earn you a few dollars in interest every month but charge you a $15 fee, you aren’t coming out ahead.

Plan your usage

Knowing how you are likely to use an account helps a lot when it comes to comparing fees, interest, and other features.

Take credit cards for example. It’s always a good idea to look for a credit card with no annual fee, but this is an especially good value if you plan on paying your balance off in full every month.

For that type of credit card customer, having no fees allows you to use the card for free. If you can also get a card that pays good rewards, that sweetens the deal all the more.

On the other hand, if you know you’ll regularly carry a balance on your credit card, the interest rate becomes more important. A high interest rate could easily cost you more than the value of any rewards you earn.

It also matters if you expect to at least make the minimum required payment on time every month. If you occasionally miss a payment, you need to pay close attention to late fees when choosing a credit card.

That’s just one example of how the cost of a banking product depends on how you use it. For that reason, the same bank may not always be the best choice for different types of customers.

Fortunately, online resources can provide you with information on multiple bank products all in one place, to make comparison shopping easier.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836

How do banks make money if I pay off my credit card balance every month?

If you pay off your balance every month, you can avoid fees and interest charges. Banks know some customers will do this, but those who don’t ensure that banks will profit from cards. Also, merchants a fee to the bank for processing the purchases their customers make with credit cards.

Are online banks as safe as traditional banks?

Increasingly, online banks and traditional banks are the same. As long as they have federally-insured deposits, your money is safe with either one. There can be some added risks to banking online, but you can minimize these risks by being careful with your passwords and not accessing your accounts on public networks.

What type of account should I choose for Direct Deposit of my paycheck?

You can have your paycheck deposited into a savings or checking account. People often choose a checking account because they can readily pay bills with that account. However, it may help you save money to have your pay deposited to a savings account, and then a monthly allowance transferred to your checking account for bill payments and other expenses.