Spending Money Wisely

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

Do you have a budget? Do you know where your money goes each month?

Keeping a budget helps you develop and maintain good spending habits. Your budget helps you stick to spending priorities that build good financial health, protecting you from the forces that are trying hard to get you to spend your money: advertising that creates a desire for things you don't need, and credit cards that make "buy now, pay sometime later" easy.

Check Your Financial Health Now

Spend Money Wisely - Improve Your Financial Health

Do you track your spending? Do you spend more than you make? Do you use savings or credit cards to make up the difference?

Budgeting is a crucial part of your financial health. When you spend money thoughtfully, you increase your chances of putting money into savings, understanding the size payment you can afford if you need a home or auto loan, and to establish realistic short and long-term financial plans.

Creating a budget isn’t difficult. Bills.com created a budget guide that helps you categorize, monitor, and track your spending and income, and explains the process of creating and maintaining a budget.

Get the Bills.com Budget Guide

Where Do You Spend Your Money?

Poor or rich; struggling to get by or living comfortably, the main spending categories are the same for everyone: housing, transportation, food, medical, utilities, household goods, etc..

Breaking down your spending into categories and sub-categories, makes it easier to monitor and analyze your spending. Budget categories give you a clearer picture of the areas in which you spend too much. Tracking them month-to-month proves whether you are changing your spending habits.

How Much Do You Spend?

You probably can easily answer, "How much do you spend each month on housing ?" But can you accurately answer, "How much do you spend on food each month?" Food costs are one of you largest monthly expenses, so it's interesting to see how close your answer is to the real figure.

Without tracking your spending, it is hard to control overspending. It's even difficult to find the areas where you should make changes in your spending habits. Take a look at what the numbers show and use that to make sure your spending priorities and spending habits align.

Spending Money and Your Financial Health

- Step 1: Things are Good, Barely Getting By, or Headed Downhill The most important first step you can take to improve your financial health is to get an accurate record of how you spend your money. Do you cover your basic bills on your income alone? Is your debt level rising each month? Are you saving money for emergencies and retirement?The first two questions in the new Bills.com Financial Health Survey focus on your spending habits.

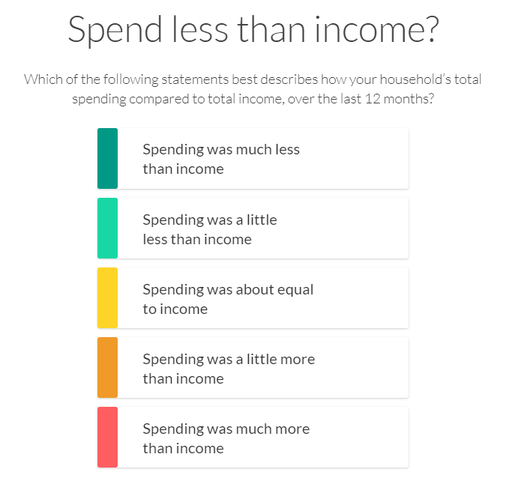

- The Financial Health Survey - Question 1

The first spending question is: "Do you spend less than your income?"You can choose one of the five answers below.

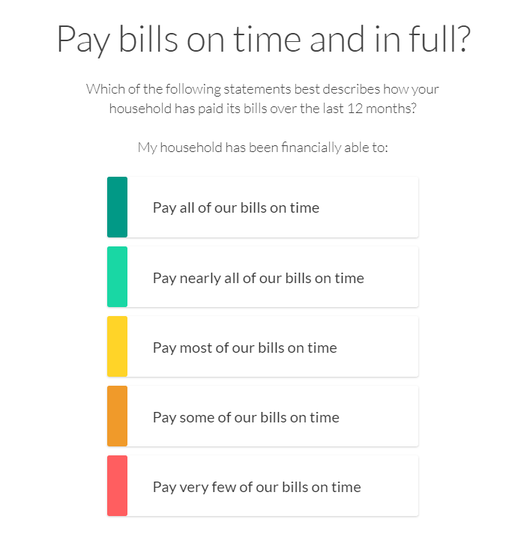

- The Financial Health Survey- Question 2

The Second question about spending is: "Do you pay bills in time and in full?"

Again, there are five answers for you to choose from.

- Check Your Financial Health Our new Financial Health Survey will give you a Spending Health Score, as well as your overall Financial Health Score, and provide recommendations to help you maintain and improve your score.

Get Your Financial Health Score Get Started

Spending Money - People Also Ask

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836

What is a Good Budget Tool?

The best budgeting tool is one that you use. There are a number of different budgeting applications. Some apps are easier to use than others. Some require you to share banking and account information.

Review a few of the most popular budgeting applications. If you are old-fashioned, you as envelope method. The important thing is to find a budgeting system that works for you and stick to it.

I Can't Afford My Bills. What Do I Do?

If your income isn't enough to cover your bills, you have two options: Increase your revenue, or decrease your expenses.

Check out the Bills.com Ways to Save Machine for ideas on how to cut expenses. However, if you are struggling with debt, then check out Bills.com's Debt Payoff Calculator to review the different options ways for handling your debt. Solutions offered are based on the goals and priorities you provide.

Collection Agencies are Calling Me. What should I do?

When collection agencies are calling it may be too late for the options presented by the Debt Payoff Calculator, but you should still look first look there for a personalized solution.

However, don't neglect collection calls and letters. If you don't pay your debts, you might be sued? For more information about dealing with delinquent debt, check out Bills.com articles about collection laws, statute of limitations, and dealing with collection agencies.

How Does a College Student Deal with Everyday Costs?

We can often learn by hearing about how other people handle the financial challenges we share. Bills.com provides a place for you to learn from others and to share what you have learned.

Maya Bluthenthal is a freshman at Columbia University who brings a fresh perspective to the financial challenges that college students and young adults face.

In one of her posts she shared some thoughts about a big freshman year challenge. "For many, this new environment means new friends, new fun, new dining options – and sometimes new stresses. It’s also the ascent into adulthood. No longer surrounded by the people whose job it was to take care of you for 18 years, college is a chance to take ownership for yourself, which, if you are doing correctly, includes establishing patterns of healthy living."