Mortgage payments are one of the most common monthly bills. Low interest rates make it very attractive to refinance and mortgage rates are still very low.

There are a number of reasons to refinance your mortgage. One common reason is to lower your monthly payment. Lower mortgage payments can help people for a number of reasons, including paying bills on time, debt, dealing with debt, financing a college education, or putting sufficient funds in a retirement account.

Whether you are struggling with payments, or just want to have more money available, refinancing your home to lower the monthly mortgage payments can improve your financial situation. Replacing your current loan with a longer-term refinance loan, usually a 30-year fixed rate mortgage (FRM) is a good way to reduce monthly mortgage payments.

Lower Mortgage Payments - Can You Qualify?

Before you refinance, you need to check to see if you qualify. Three important factors to consider are:

- Is your credit score sufficient? One thing you need to make sure of is that your credit score is sufficient to qualify for a mortgage. Although FHA loans require a 580 score, conventional loans require at least a credit score of 620. However, lenders might (and usually) have stricter requirements.

- Do you have equity in your home? Many homeowners lost equity in their home after the Housing Crash of 2008. However, home prices in many areas has risen dramatically. The rise in value coupled with payments over a number of years has put many borrowers into a positive equity position.

- Do you have sufficient income? You will need to meet any income and debt requirements. By lowering your monthly payment, you will decrease your debt to income ratio. However, even though you are lowering your mortgage payments, you still need to qualify for the new loan.

Get Rid of Mortgage Insurance

If your equity position has increased below 80% then you might qualify for a mortgage without private insurance. In fact, there is a trend of borrowers looking to refinance out of a FHA loan and into a conventional loan. Get a mortgage rate quote now.

Comparing Your Options – Will Refinancing Lower Your Payment?

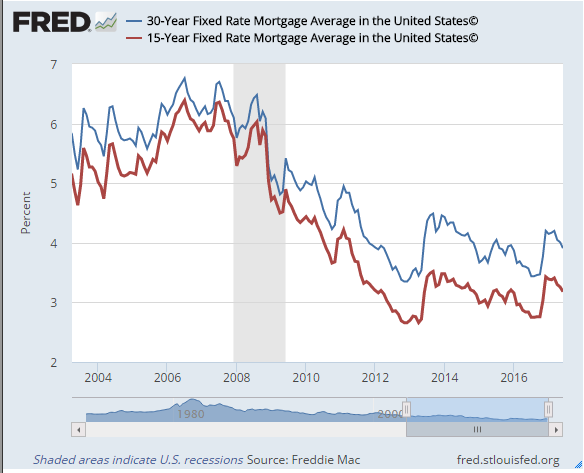

Comparing Your Options – Will Refinancing Lower Your Payment? Interest rates have changed over the past 13 years. Check out the graph below to see how FRM interest rates have changed since 2004.

Source: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States© [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, June 21, 2017. And Freddie Mac, 15-Year Fixed Rate Mortgage Average in the United States© [MORTGAGE15US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE15US, June 21, 2017.

When you refinance to lower your payment, you need to consider a few factors:

- How long are you going to take the loan?

- Will you extend the loan to a 30-year loan, keep the length similar to your current loan, or try to pay it off quicker? What is the interest rate on your new refinance?

- What are the fees and upfront costs on your refinance?

- How much mortgage insurance will you have to pay? And, for how long?

Example 1: Lower Payments - Big Interest Rate Difference and Older Loan

Here is an example of refinancing a $200,000 mortgage (current balance), that was taken 10 years ago, at 6.27%. Based on a new rate of 4.05%, your 30-year refinance mortgage loan would have a monthly payment of $961. The refinance loan would put $493 in your pocket each month for the first 20 years.

Here is the amount of savings you would have on your interest payments. Remember, you will be paying off your loan at a lower monthly payment but will have 10 years of additional payments. Also consider closing costs, including lender fees and third party costs when calculating your overall savings.

Quick Tip

Check out Bills.com mortgage rates to see how much you can lower your payment based on today’s mortgage rates.

Example 2: Lower Payments - Small Interest Rate Difference and Newer-age Loan

Here is an example of refinancing a $200,000 mortgage (current balance), that was taken 6 years ago, at 4.84% and a monthly payment of $1,175. Based on a new rate of 4.05%, your 30-year mortgage refinance loan would have a monthly payment of $961. The refinance mortgage loan would put $215 in your pocket each month for the first 24 years.

Here is the amount of savings you would have on your interest payments. Remember, you will be paying off your loan at a lower monthly payment but will have 6 years of additional payments. Also consider closing costs, including lender fees and third party costs when calculating your overall savings.

Bills Action Plan

If you are having trouble making your payments, or want to free up money for other needs, then refinancing to lower your payments makes sense. I recommend that you take these steps:

- Check the value of your home on an online site like Zillow or Trulia.com, or with a local agent, If a high LTV was preventing you from refinancing, then now might be a good chance to refinance. If your LTV is 80% or under, then you possibly won't need mortgage insurance.

- Even if your home value is over 80%, you can refinance with a conventional loan, but you will need to pay for private mortgage insurance.

- Check your credit report and credit score. You will need at least a 620 score to qualify for a conventional loan, and 580 for a FHA loan, although most lenders will require a much higher score. All FHA loans require mortgage insurance is more expensive, including upfront fees and higher monthly insurance premiums.

- Check out Bills.com mortgage rate tables and compare offers from different lenders.

A Great Reason to Refinance Your Mortgage - Lower Your Payments.

Get a mortgage quote from a Bills.com mortgage provider.