Mortgage Insurance and HARP refinance

- You can do a HARP loan if you have Mortgage Insurance.

- This is true for both PMI types: LPMI (Lender) and BPMI (Borrower).

- Find links to the MI companies sites and service departments.

A HARP 2.0 Loan is Possible With Mortgage Insurance

There has been much talk about the availability of refinancing underwater houses through the HARP 2.0 program, for borrowers with MI (Mortgage Insurance), either BPMI (Borrower’s Private Mortgage Insurance or often referred to just as PMI) or LPMI (Lender Private Mortgage Insurance).

March 2012 will be another key date in the HARP 2.0 program, when participating lenders will be able to offer HARP loans through their automated underwriting systems.

Are you eligible for HARP?

bills.com can help you find harp loans. with rates at historic lows, it pays to apply now.

Both Freddie Mac’s LP Relief Refinance Mortgage and Fannie Mae’s DU Refi Plus loans will be offered by all participating lenders. That means, if you qualify for the HARP 2.0 program, you do not have to go to your original lender to be approved on the manual system. It also means that if you have PMI or LPMI, you can start to shop around for another lender.

HARP Eligibility

The HARP 2.0 program made some basic changes in the program to allow more borrowers to refinance mortgage loans with underwater property. All HARP loans have to have a settlement date with Freddie Mac or Fannie Mae on or before May 31, 2009. Here are the six main points, as relates to the automated underwriting systems:

- Mortgage Payment History: No late payments within the last 6 months and no more than 1 late for 30 days in the most recent 7-12 months.

- LTV: No maximum LTV for fixed rate mortgage with term up to 30 years. For loans up to 40 years, or Adjustable Rate Mortgages that are eligible for the program, there is a maximum of 105%.

- Debt-to-Income (DTI) ratio: There is a maximum, generally 45%, according to the underwriting standards set by Fannie Mae and Freddie Mac.

- Occupancy: No original occupancy requirements.

- Type of Property: In general, any owner-occupied home, rental, or investment property is eligible. The program is available for condominiums and cooperatives, although there are certain restrictions.

- FICO: No minimum FICO score, unless payment increases by more than 20%, in which case the minimum FICO score is 620.

This is by no means an exhaustive list. There are many time very technical questions regarding eligibility that relate to Fannie Mae or Freddie Mac procedures, and must be clarified with the lender. For more information, see the excellent Bills.com article about the HARP mortgages program.

HARP and PMI:

Since the beginning of the HARP program in 2009, the government encouraged the refinance of loans that had MI. However, there is much evidence that MI was a problem in the HARP process. Fannie Mae and Freddie Mac have made it clear regarding their eased requirements for MI.

Fannie Mae, in their FAQs, specifically related to MI, in the following manner:

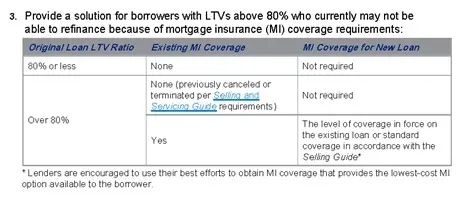

Provide a solution for borrowers with LTVs above 80% who currently may not be able to refinance because of mortgage insurance (MI) coverage requirements:

Fannie Mae’s basic requirement is that the same coverage that was on the existing loan be carried over to the new loan. They do qualify their statement, which means that there will be odd cases that must be covered differently. They also state that the MI companies are supportive of the programs for loans that they already insure.

HARP 2 Updates

Read the Bills.com HARP 2 mortgage page for the latest updates about HARP.

Four MI Requirements for HARP 2.0

It is up to the lenders to offer the best package possible, although there is not much flexibility. When looking to refinance your loan through the HARP program, you will need to find a lender that works with Fannie Mae or Freddie Mac and your mortgage insurance company. Remember, after March 2012 you can work with new lenders.

Some of the mortgage insurance companies have run into financial trouble, and are not issuing new insurance policies. However, even these companies (such as Triad, PMI, and RMIC) are permitted to modify existing policies according to the HARP guidelines.

In general, the MI companies have made clear directives to refinancing HARP loans. Here are four main points:

1. Representations

The MI companies will not require more representations than does the GSE’s, Fannie Mae and Freddie Mac. If your lender approved your HARP loan, through the DU Refi Plus Loan or the LP Relief Refinance Mortgage, then it does not have to provide new or different information to the Mortgage Insurance Company.

2. Products

The MI companies will allow you to switch between BPMI and LPMI. This has been a problem for many, as lenders have refused to do a HARP loan, because there was LPMI on the loan. With the new program, they can offer this option, but you should check carefully if the added interest is justified.

3. Pricing and Coverage Percentage

In general, the GSE’s have agreed to accept the same coverage percentage. In general, the rates will be based on those in the original loan. There may be minor adjustments, if there is a change in the sum of the loan.

4. Technicalities

The mortgage insurance industry, like the mortgage industry, has many rules and guidelines. These should be worked out between the lender and the MI company. Anytime you do not understand a ruling, make sure that your lender provides a clear answer.

Working with the Lender and the MI Company

In general it is up to the lender to put together the best loan package will include the interest rate, mortgage fees (origination and discount points), represent all third party fees, and Mortgage Insurance. However, when doing a HARP loan, your lender will need to work with your current Mortgage Insurer. The details of the insurer should be available through the automated underwriting system. If not, the lender should contact Fannie Mae or Freddie Mac.

You, the borrower, should also be aware of the MI company that handled your BMPI. The mortgage insurance company is required to provide you information at the time of the origination of the loan, as well as an annual statement, which will remind you of your right to cancel.

Here is a list of the major mortgage insurance companies and a link to pages that deal with HARP:

| Mortgage Insurance Co. | Contact Number | Company Web Resources |

|---|---|---|

| MGIC | (800) 424-6442 | MGIC HARP FAQMGIC’s Refi-to-Mod (RTM) Programs |

| Radian | (877) 723-4261 | Radian HARP Eligible Modification Program |

| Genworth | (800) 444-5664 | Genworth November 2011 update |

| PMI | (800) 366-1143 | PMI New Servicer page |

Conclusion: A HARP Loan is Possible with Mortgage Insurance

Underwriting guidelines, by nature, are complicated. This is true for the mortgage underwriting guidelines set out by Fannie Mae and Freddie Mac. This is also true for mortgage insurance underwriting guidelines.

The good news is that the MI companies have simplified the process, relying on the lenders to verify that the borrower is eligible for a HARP refinance loan. The new HARP 2.0 program will be rolled out in its automated version by Mid-March 2012. This means that you, the borrower, will be able to switch from one lender to another. There are no barriers, from the mortgage insurance companies’ side to refinancing with LPMI, either from the same lender or a new lender. Both types of private mortgage insurance are eligible, BPMI and LPMI.

Bills.com will continue to keep you informed of the changes made in the HARP 2.0 program on the HARP mortgage page.

10 Comments

I am not sure who your current lender is and which company holds your current LPMI, as I was not able to find information about GEMC. Do you have contact information for them?

However, I would like to clarify a few points: 1. Fannie Mae and Freddie Mac allows and encourages lenders and mortgage insurance companies to participate in the HARP program. However, participation is voluntary. Some mortgage companies, such as GMAC, do not allow for a HARP refinance if you current loan has LPMI. (A GMAC official informed me, erroneously so, that the HARP program does not allow a loan with LPMI to be refinanced in the HARP program. That is a decision made by the company). 2. You can, if your mortgage insurance company participates, transfer a LPMI loan from your current lender to a new lender. Obviously, you have to be eligible for a new lender automated HARP loan. 3. There are some instances whereby the original lender had to provide additional credit enhancements, including mortgage insurance, to Fannie Mae which disqualify the loan from a HARP mortgage. These are exceptions to the general rule that LPMI is transferable to a new HARP loan and to a new lender

I do not believe that the Home Owners Protection Act of 1998 requires a lender to refinance, however there are disclosure issues. The lender should have notified you about the LPMI at the time it was taken out, as well as the time the reaches the 78% LTV level based on the original loan. If you do see a lawyer, please keep us informed regarding your progress.