HomeReady Mortgage - A Low Down Payment Option

- The HomeReady Mortgage is Fannie Mae's low down payment mortgage.

- The HomeReady targets low to moderate income homebuyers in specific geographic regions.

- You can benefit from this program especially if your credit score is over 680.

HomeReady Mortgage - Buying a Home with a Low Down Payment

Can you buy a home with only a 3% down payment?

Many households think that they need a significant down payment to buy a home. The truth is that there are low down payment mortgage programs, including FHA loans, VA loans, and Conventional loans.

One popular option is Fannie Mae’s HomeReady Mortgage, which began in 2015 to serve low to middle-income homebuyers and homeowners. Like other conventional mortgages, the HomeReady Mortgage requires mortgage insurance if the loan to value ratio (LTV) is over 80%

Note: The Fannie Mae HomeReady Mortgage is also available for certain high LTV refinance scenarios.

Who Can Get a HomeReady Mortgage?

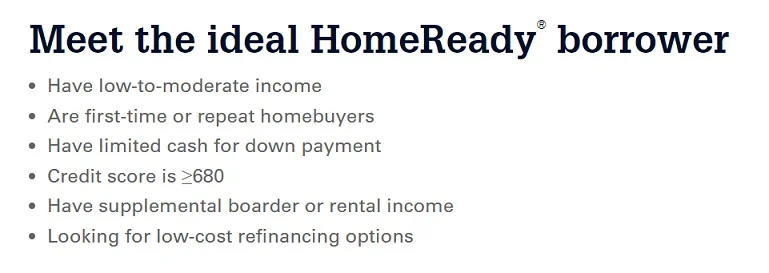

The HomeReady Mortgage is available for low to moderate income borrowers. It can include first-time and repeat homebuyers.

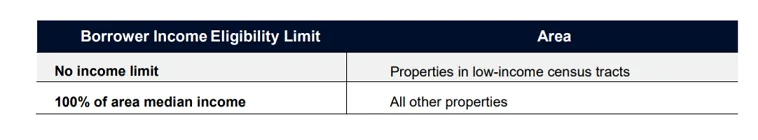

The program has income and geographic limitations. Unless the property is in a low-income tract, the borrowers’ income cannot exceed, 100% of the county area median income (AMI). You can check if you qualify by using this tool.

How do you match up with Fannie Mae’s description of an ideal HomeReady Borrower?

Borrower Requirements - HomeReady Mortgage

The HomeReady Mortgage targets low to middle-income borrowers. If the property is not in a low-income tract, then there are maximum income requirements.

The standard credit score requirements for a Fannie Mae loan is 620. However, the HomeReady Mortgage has built-in discounts to the lender if your credit score is 680 or more. Lenders requirements vary, so shop around.

Also, lenders can qualify borrowers without credit scores, but the LTV cannot exceed 95%. The maximum debt to income requirement is 50% for an automated underwritten loan. A manually underwritten loan has a maximum DTI of 45%.

Fannie Mae is making the loan more accessible through innovative underwriting flexibilities. The flexibilities include allowing for a rental unit and boarder income, and the addition of a non-occupant borrowers income to count toward your overall creditworthiness. These flexibilities can be especially helpful for many millennials, whose parent's income can make the difference between being approved or denied.

Key Benefit: Low Down Payment Requirements

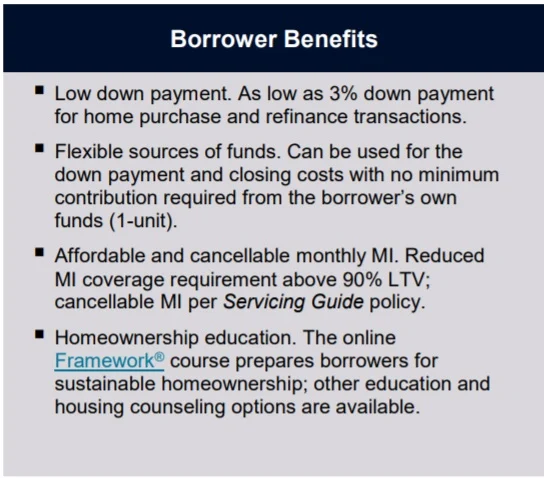

The main benefit of the HomeReady Mortgage is that you need to bring extraordinarily little or no money to the table. You can purchase a home with an LTV as high as 97%, and even finance the whole purchase without any of your own money.

One of the major obstacles for many potential homebuyers is finding money for the down payment. The Home Ready Mortgage offers flexibility, and it is possible that you can buy a home without using any of your own cash. Down payment can come from a variety of sources, including family, employee-assistance programs, secondary financing, and sweat equity. Mortgage rules are complicated, so check with your lender that you are doing things by the rulebook.

Other Benefits:

Another big benefit of the HomeReady Mortgage is that Fannie Mae offers reduced Mortgage Insurance Coverage requirements, which means lower costs to you. Also, unlike FHA loan, the mortgage insurance is automatically canceled when your LTV reaches 78%, based on your original payment schedule. Also, it can be canceled when your LTV drops below 80% of the homes appraised value.

The fourth benefit that Fannie Mae talks about is Homebuyer Education. As Fannie Mae states,

Knowledge is power. That’s why the HomeReady® mortgage homeownership education requirement is designed to help borrowers gain essential knowledge to prepare for sustainable homeownership and to help lenders gain informed borrowers prepared to successfully navigate the loan process

Fannie Mae requires an approved online course. However, they encourage using an approved HUD counselor. Counseling fulfills the HomeReady homeownership education requirement. Not only does the counseling help you be a better consumer, but Fannie Mae also offers the lender a $500 credit toward each loan

Low Down Payment - Check Your Options

If you are looking to purchase a home, but have minimal funds for a down payment, then check your options. The Home Possible is a unique program, and you may not qualify because of Income Requirements, or credit score requirements.

Here are two other possibilities:

One of the most popular options is the FHA mortgage. The FHA mortgage offers an LTV up to 96.5% (a down payment of only 3.5%), however, has both an upfront mortgage insurance charge as well as a monthly mortgage insurance payment. Other viable options for special circumstances are VA loans and USDA/RHF rural mortgage loans.

In April 2018 Freddie Mac introduced the HomeOne Mortgage, which is similar to the Home Possible mortgage, without the restrictions on income and geography. This option allows a borrower to take out a Fixed Rate mortgage with only 3% down.

Home Ready looks like a great program for first time home buyers... thanks!

We agree. The low down payment, ability to qualify for high LTV loans, and the loosening of "seasoning" requirements on the source of the down-payment funds all contribute the Home Ready program's efforts to help first-time home buyers.