Home Possible Mortgage - Low Down Payment Mortgage

- The Home Possible is Freddie Mac’s Flagship Low down payment mortgage.

- The Home Possible targets low to moderate income homebuyers in specific geographic regions.

- Freddie Mac also offers The HomeOne Mortgage for a broader population.

HomeOne Mortgage - A Low Down Payment Option

Do you want to buy a home, but don’t have a lot of savings to make a large down payment? You may not be aware, but there are a number of low down payment mortgage programs.

A few years ago Freddie Mac introduced the Home Possible Mortgage, a special mortgage program for homebuyers with a small down payment and a high loan to value ratio (LTV). The Home Possible Mortgage allows for a down payment as low as 3%, and even lower for homebuyers with special assistance programs.

According to a Freddie Mac press release from January 15, 2019:

"...its flagship Home Possible®mortgage origination program has exceeded $50 billion in home mortgages that were provided to 262,328 families across the United States.

Note: Freddie Mac combined the Home Possible and the Home Possible Advantage Mortgage into one program. Effective October 29, 2018, it is now just the Home Possible Mortgage.

Who Can Get a Home Possible Mortgage?

The Home Possible Mortgage is available to low to moderate income borrowers. It can include first-time and repeat homebuyers. The program has income and geographic limitations. Unless the property is in a low-income tract, the borrowers’ income cannot exceed, 100% of the county area median income (AMI). You can check if you qualify by using this tool.

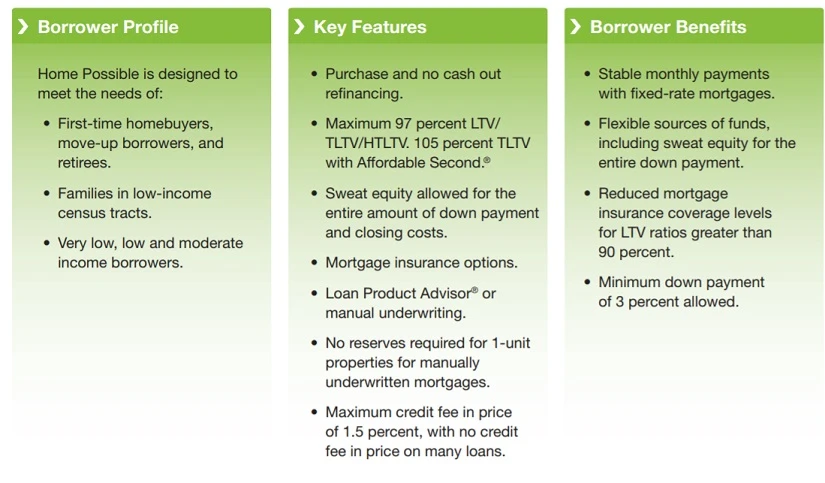

Freddie Mac designed the Home Possible to meet the needs of:

“• First-time homebuyers, move-up borrowers, and retirees.

• Families in low-income census tracts.

• Very low, low and moderate income borrowers”

Key Benefit: Low Down Payment Requirements

The main benefit of the Home Possible Mortgage is that you need to bring very little or no money to the table. The program allows for a down payment of only 3%. If you qualify for an Affordable Second Mortgage you can obtain up to 105% LTV.

Flexible Sources of Down Payments: One of the major stumbling blocks for many potential homebuyers is finding the money for the down payment. The Home Possible Mortgage offers flexibility and,

Down payment can come from a variety of sources, including family, employee-assistance programs, secondary financing, and sweat equity.

Reduced Mortgage Insurance Costs: One advantage of the Home Possible mortgage is that Freddie Mac offers lower mortgage insurance costs. The mortgage insurance is automatically canceled when your LTV reaches 78%, based on your original payment schedule. Also, it can be canceled when your LTV drops below 80% of the homes appraised value.

Borrower Requirements - Home Possible Mortgage

The Home Possible Mortgage targets low to middle-income borrowers. If the property is not in a low-income tract, then there are maximum income requirements.

Credit Score: The standard credit score requirements for a Freddie Mac loan is 620. However, many lenders have stricter standards. Also, lenders can qualify borrowers without credit scores, but the LTV cannot exceed 95%. The maximum debt to income requirement is 50% for an automated underwritten loan. A manually underwritten loan has a maximum DTI of 45%

Non-Occupant Borrower: At least one borrower must occupy the mortgaged premises as a primary residence. However, the new program allows you to add a non-occupying buyer as a co-borrower. If the borrowers’ income is not sufficient, the new program allows adding a non-occupant borrower. The LTV requirement is 95%, and the occupying borrower’s DTI cannot exceed 43%.

Homebuyer Education: Homeownership education is required when all of the borrowers are first-time homebuyers or if the credit reputation for all borrowers is established using only Noncredit Payment References. Freddie Mac offers a free, online CreditSmart® program or you can use another acceptable homeownership education program.

Recap of Key Program Points - Home Possible Mortgage

To make the low down payment program more accessible Freddie Mac, in August 2018, combined their Home Possible and Home Possible Advantage Mortgage offers into one program. Here are some of the main points of the Freddie Mac Home Possible Mortgage:

Low Down Payment - Check Your Options

If you are looking to purchase a home, but have minimal funds for a down payment, then check your options. The Home Possible is a unique program, and you may not qualify because of Income Requirements, or credit score requirements.

Here are two other possibilities:

One of the most popular options is the FHA mortgage. The FHA mortgage offers an LTV up to 96.5% (a down payment of only 3.5%), however, has both an upfront mortgage insurance charge as well as a monthly mortgage insurance payment. Other possible options for special circumstances are VA loans and USDA/RHF rural mortgage loans.

In April 2018 Freddie Mac introduced the HomeOne mortgage, which is similar to the Home Possible mortgage, without the restrictions on income and geography. This option allows a borrower to take out a Fixed Rate mortgage with only 3% down.