Upswing in High LTV Loans in HARP 2 Program

- The original HARP refinance program allowed for LTVs up to 105%.

- The HARP 2 program allows for unlimited LTVs.

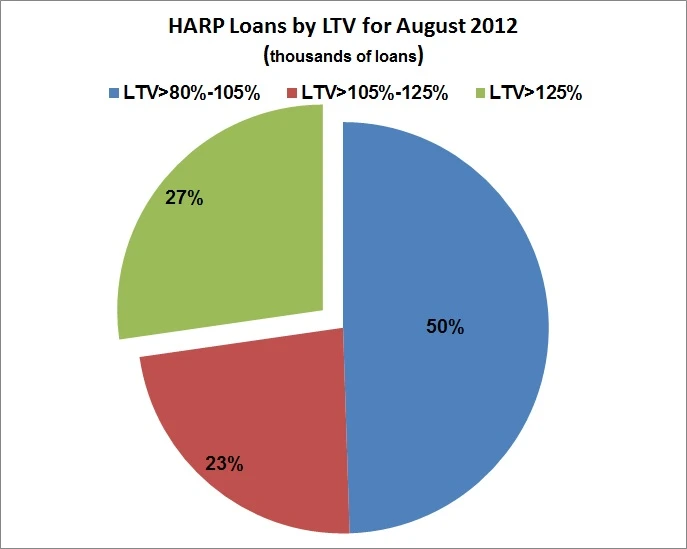

- During the month of August 2012, 27% of the HARP loans had more than 125% LTV.

Refinance with a High LTV with HARP 2

The HARP mortgage program picked up steam since the inception of the HARP 2 program. Home Affordable Refinance Program (HARP) was initiated under the Making Homes Affordable Program in 2009. It allows certain underwater borrowers to refinance their loans at historically low mortgage rates.

To be eligible for a HARP loan, your current loan must have been originated and delivered to Fannie Mae or Freddie Mac before June 1, 2009. From May 2009 to Dec. 2011, about 900,000 borrowers refinanced under the HARP program, far fewer than the Obama Administration hoped.

The Obama Administration expanded HARP in October 2011, aiming to increase the number of HARP borrowers. One key change in what was called HARP 2.0 was to allow loans with an unlimited loan-to-value ratio (LTV). This increased the number of eligible borrowers and boosted the HARP refinance loans.

HARP 2 Updates

Read the Bills.com HARP 2 mortgage page for the latest updates about HARP.

HARP 2.0 and Unlimited LTVs

The original HARP program had a 125% maximum LTV limit. The HARP 2.0 program was first released for manually underwritten loans in Nov. 2011, then expanded to automated underwriting systems in March 2012. HARP 2.0’s new rules included:

- Unlimited LTV for Fixed Rate Mortgage (FRM) up to 30 years (10-, 20- and 30-year loans)

- 105% LTV limit for FRM more than 30 years up to 40 years

- 105% Maximum LTV for Adjustable Rate Mortgage up to 40 years with initial fixed period 5 years or more.

Despite the fact that HARP 2 rules allow for unlimited LTVs, many lenders apply stricter underwriting criteria, and limit HARP 2 loans to 125%.

Quick Tip # 1

If you have an eligible HARP loan, but have a high LTV, then shop around. Get a HARP 2.0 mortgage quote from a Bills.com mortgage provider.

HARP 2.0 - Helping High LTV Borrowers?

At the beginning of the HARP program, there were an estimated 4 to 5 million underwater Fannie Mae and Freddie Mac borrowers. About 1.6 million borrowers refinanced under the HARP 2 program as follows:

- May 2009 through 2011: 922,000 borrowers in 31 months

- Jan. through Aug. 2012: 618,000 borrowers in 9 months

The general market expectations is that about another 400,000 borrowers will close their HARP 2 loans by the end of 2012. Based on those numbers, you can see that the new HARP guidelines coupled with historically low interest rates has greatly boosted the HARP mortgage refinance volume.

However, how much have the high LTV borrowers been helped? The Federal Housing Financing Agency (FHFA) published in October 2012, their August 2012 Refinance Report (PDF). Here are some key statistics:

- Since the second quarter of 2012 (the automated rollout of the HARP loans was on March 19, 2012), HARP refinance loans account for 24% of all refinance loans.

- More loans are shorter-term loans. 18% of HARP loans originated in August 2012 were 15-20 year loans.

- LTVs over 105% accounted for more than half of the loans in 8/12, versus 41% for the first 8 months of 2012.

- The share of HARP Loans with LTV over 125% increased to 27% of all HARP loans in August 2012.

- About 58% of the loans in August 2012 were Fannie Mae Loans.

The table below shows the number of HARP loans and their distribution by different LTV levels for August 2012 and for the first eight months of 2012:

| LTV Ratio | August 2012 | Share of Loans by LTV | Jan 2012 - August 2012 | Share of Loans by LTV |

|---|---|---|---|---|

| 80% - 105% | 48,676 | 49% | 361,697 | 59% |

| 105% - 125% | 23,675 | 23% | 138,050 | 22% |

| >125% | 26,944 | 27% | 118,470 | 19% |

| Total | 98,885 | 100% | 618,217 | 100% |

Source: FHFA August 2012 Refinance Report

The chart below shows that for August 2012, 50% of HARP 2 loans have more than 105% LTV, and 27% have more than 125%.

According to the FHFA report, key hard-hit states such as Florida, Arizona and Nevada had more than 70% of their HARP loans over 105% LTV. California had more than 60% HARP loans over 105%. The good news is that loans with LTV over 125% accounted for high percentages in those states, as follows:

- California: 39%

- Florida: 50%

- Nevada: 68%

- Arizona:71%

Quick Tip #2

To learn more about new mass refinance proposals, read the Bills.com article about HARP 3.0.

HARP 2 Loans and High LTV – Do I Qualify?

The HARP 2 program is bearing fruit for many underwater borrowers. A high percentage of successful borrowers refinanced with LTVs over 125%, especially in the hard-hit areas.

Many lenders are still limiting LTVs. Some stop at 105%, some at 125%, some at 140%. Although the HARP program has more flexible underwriting criteria, many lenders also have their own "overlays" — stricter criteria — for debt-to-income ratio, credit score, and property type, just to name a few. Overall, the HARP 2 numbers are encouraging. If you have an underwater home (or any LTV over 80%) and are eligible for the HARP program, then shop around with different lenders to find the best deal. Remember, if one lender turns you down, another lender may be willing to work with you.

Quick Tip #3

Get a HARP 2 mortgage quote from a participating Bills.com mortgage provider. Mortgage rates are at historical lows.