- Mortgage rates are still historically low.

- Check your options: Lower your monthly payments (30-years) or pay off your mortgage quicker (15 years).

- Cash-out Mortgage refinances can help your finances.

2018: Mortgage Refinance Opportunities

Are you still considering a mortgage refinance? If you haven’t already taken advantage of low mortgage rates, it isn’t too late.

A mortgage refinance can help you improve your finances. When looking to refinance in 2018, take a good look at your income, debt, and assets. Then match your financial goals to the type of mortgage that fits your needs. For example, if you have a strong cash-flow, then take advantage of lower rates on a 15-year mortgage .You will get out of debt quicker and increase your savings. However, if you are struggling with your monthly bills, or just want to free up money for other purposes (including your investment and retirement funds), then stretch out your payments to a 30-year loan.

It is important to shop around, compare rates and fees, and make sure that the mortgage refinance fits your financial situation.

Refinance in 2018

There are many good reasons to refinance your mortgage in 2018. Take advantage of low rates and get a mortgage quote now.

2018 Refinance Mortgage Rates are Still Low

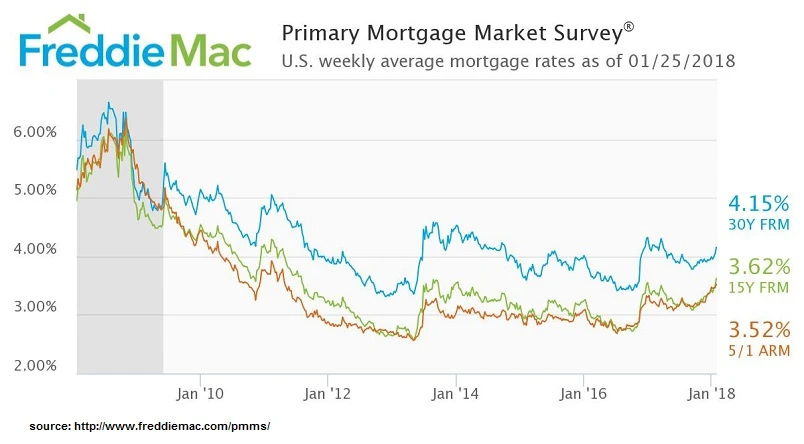

Mortgage rates started off in 2018 around the 4% level. There are some signs that as of the end of January 2018 the rates are on a slight rise.

Check out weekly mortgage rate averages as reported by Freddie Mac. While mortgage rates took a serious dive in 2012, rates are back up to 2014 levels and still way below the much higher rates mortgage borrowers faced in 2009.

Of course, we all ask ourselves: Will rates go higher in 2018? While nobody has an accurate crystal ball, the current forecasts are that mortgage rates will go higher. The general consensus is that rates will rise during 2018, but still remain under 5%.

Check out the graph below to see three different forecasts:

source:

https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-and-commentary

https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-and-commentary

http://www.fanniemae.com/resources/file/research/emma/pdf/Housing_Forecast_012218.pdf

2018: Consider a Cash Out Refinance

One popular reason to refinance in 2018 is because you want to take out some of the equity in your home. Keep in mind that your home is an important asset and is often an important source of your net worth, especially in retirement.

While not all areas are equal, home prices have risen in many parts of America. According to the Black Knight November 2017 Mortgage Monitor report:

As of Q3 2017 approximately 42 million homeowners with a mortgage have nearly $5.4 trillion in equity available to borrow against, assuming a maximum 80 percent total loan-to- value ratio

Black Knight also reported that Cash-out mortgages for Q3 2017 were over 62% of all refinance transactions. The average amount of equity taken was about $68,000.

If you need money for home renovations, pay off student loans, credit card debt, or for many other reasons that can help your financial situation, then 2018 might be a good year to check out a cash-out refinance.

Mortgage Refinance in 2018: Many Attractive Options

2018 started off with low interest rates. Forecasts indicate that rates will increase, and the month of January 2018 saw a jump in rates, but still below 5%.

Before you refinance make sure that you check your finances and then match your goals with the right type of mortgage product. Here are some of your options:

- Lower your payments by taking out a 30-year FRM

- Pay-off your mortgage faster with a 15-year FRM

- Check out a conventional loan and get rid of Mortgage Insurance payments.

- Tap into your equity with a cash-out mortgage refinance. (If you have a good interest rate on your current mortgage, then consider a home equity loan.

Get a Mortgage Quote

Mortgage rates in 2018 are on the rise, but still attractive. Take advantage of low rates and rising home prices and get a mortgage quote now.