Following Mortgage Rates and Mortgage Fees

- The mortgage loan market is dynamic.

- Rates change and fluctuate.

- Keep an eye on the market, and shop for a mortgage loan.

Watching Mortgage Rates and Mortgage Fees

Market conditions determine mortgage rates. Some of the main factors are the supply and demand for money, housing, and inflationary pressures. One of the main factors to watch is the job market. A stronger and more stable job market will create more pressure on the housing market, and more pressure on the mortgage market.

One example of upward pressure on the mortgage rates was the passing of the Temporary Payroll Tax Cut Continuation Act of 2011. The law, signed by President Obama on Dec. 23, 2011 created a higher guarantee fee on Fannie Mae and Freddie Mac guaranteed loans. Some industry experts expect an increase in the mortgage rate of up to 0.5%.

Before shopping for a mortgage loan, learn about:

- The cost of a mortgage: Interest Rates, Origination Points, and Discount Points

- Mortgage Interest Rates

- Learn about points

Quick tip

contact one of bills.com’s pre-screened refinance partners, for a free, no-hassle mortgage quote.

The Mortgage Mix: Interest Rates, Origination Points and Discount Points

There are many types of mortgage fees when refinancing or taking out a home purchase loan. The two primary mortgage fees linked to the financial cost of the loan are origination points and discount points.

Some of the increase in the cost of your mortgage loan may come from an interest rate increase, and some from a raise in mortgage fees such as discount points or origination points. Whenever shopping for a mortgage loan, evaluate your needs and weigh together the mortgage rates and mortgage fees, based on the time period you will be holding on to the loan.

Before I explain about these mortgage fees, let us look at the mortgage market and mortgage rates.

Mortgage Rates

Mortgage Rates are at historical lows. To get a better picture of where you stand in today’s market, here are some statistics about mortgage rates and mortgage fees.

- Average interest rates, as of January 12, 2012, for 4 different types of loans - 30 year FRM (Fixed Rate Mortgage), 15 year FRM, 5/1 ARM (Adjustable Rate Mortgage) and 1 Yr ARM, according to Freddie Mac’s PMMS (Primary Mortgage Market Survey) :

| 30 year FRM | 15 year FRM | 5/1 ARM | 1-Yr ARM | ||

|---|---|---|---|---|---|

| Average Rates | 3.89 % | 3.16 % | 2.82 % | 2.76 % | |

| Fees & Points | 0.7 | 0.8 | 0.7 | 0.6 | |

| Margin | N/A | N/A | 2.74 | 2.76 |

2. Average interest rates for 30 year fixed rate mortgage, by regions, for January 12, 2012, according to Freddie Mac’s PMMS:

| 30-Year Fixed Rate Mortgages | US | Ne | SE | NC | SW | W |

| Average | 3.89% | 3.89% | 3.91% | 3.87% | 3.95% | 3.84% |

| Fee & Points | 0.7 | 0.8 | 0.8 | 0.7 | 0.7 | 0.8 |

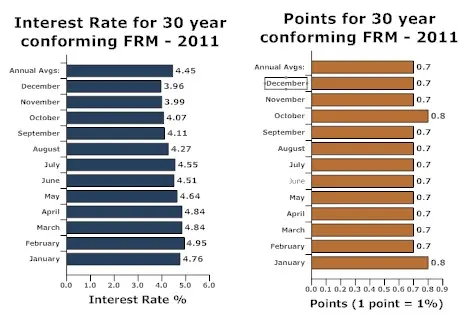

3. Historical mortgage rates and mortgage fees: 15 year fixed rate mortgage rates and points for a 12-month period from January 2011 to December 2011 based on Freddie Mac’s PMMS:

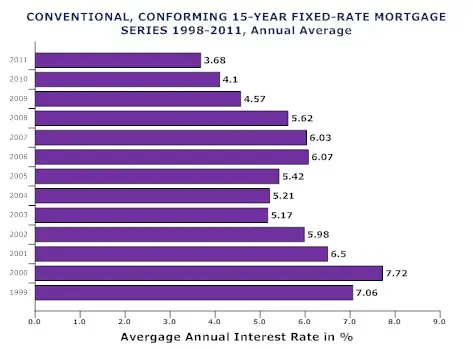

4. Historical Mortgage rates and fees: Mortgage Interest Rates are very low. They dropped from 7.72% in 2000 to 3.68% in 2011. The chart shows the average annual interest rates for 15 year fixed rate mortgage rates, as published by Freddie MAC.

Mortgage Fees: Make a point to learn about points

A Mortgage Loan, whether home purchase loans or refinance loans come with fees.

It is not enough just to look at the interest rate, but you must compare the whole package. Here are the main categories of mortgage fees:

- Bank or lender fees: origination points and discount points

- 3rd party fees: appraisal, insurance, title,

- Prepaid: money paid upfront into an escrow account for services relating to mortgage, or prepaid interest.

Bills.com has an excellent article that explains about fees and costs when taking out a mortgage loan, both refinance and home purchase loan.

The two mortgage fees to pay special attention to are the lender fee, origination points and discount points. These are financial costs, which the lender uses in determining the mix between an interest rate and fee structure. The mortgage fees are paid up front, and can be calculated into the loan to give you an adjusted financial cost. The main considerations in choosing between the mix of mortgage interest rates and mortgage point fees are the amount of time you will stay in the house, and the savings gained by the lower interest rate. For more information read Bills.com article about no cost mortgage refinancing. Also, read Bills.com article about refinance mortgage rate to learn about finding the best interest rate, based on the loan type and your financial situation.

Shop For the Best Mortgage Rate

It is important to shop around, so you can find the best rate and locate the appropriate lender.

Quick tip

contact one of bills.com’s pre-screened refinance partners for a free, no-hassle mortgage quote.

Now is a great time to take advantage of a low-rate mortgage refinance. Do your homework and make sure you understand what market rates are. Then make a smart mortgage shopping decision, using all of the tools that we make available to you. Good luck!