Today's Interest Rates | Using a Mortgage Rate Table

- Mortgage Rates are constantly changing.

- You can find today's mortgage rates in a mortgage rate table.

- Get a customized rate depending on your credit rating, LTV and other factors. Don't forget to compare rates and fees.

Interest Rates Today: Get the News

Mortgage rates are constantly changing. Will interest rates go up, or down? No one knows for sure what the future will bring. Shopping for a mortgage loan takes time. If you are in the market to buy a house and take a mortgage loan, then it will take longer than if you are looking to refinance.

Good financial planning will help you get the best mortgage rate available. Preparing your budget, improving your credit score, obtaining a low debt level, and saving a sufficient down payment and reserves are important steps to getting the best mortgage rates available.

In order to help you shop for the mortgage and keep abreast of mortgage rates, Bills.com provides you:

- Mortgage Rate Table with Today’s rates

- Comparing Historical Data to Today's interest rates

- Today’s Interest Rates and Tools to help you shop for your loan

Mortgage rates vary by market conditions, lender, and borrower. Your credit rating, geographical area, LTV, and other credit issues affect the rate you will get. No matter which table you look at, the rate you receive will most likely be different.

Mortgage Rate Table with Today’s Rates

The easiest way to check out today’s mortgage rates is to refer to a mortgage rate table.

The Bills.com mortgage rate table includes a customized option that allows you to receive today’s mortgage rates for your personal situation. This includes your credit score, the type of loan (purchase or refinance), purchase price/house value, loan amount, and zip code.

Comparing Historical Data to Today's interest rates

You may want to know whether you should immediately take out a loan, because interest rates might increase. Or, maybe interest rates are dropping, so it is better to refinance later. Nobody knows for sure which direction interest rates are going, and economic markets often bring surprises.

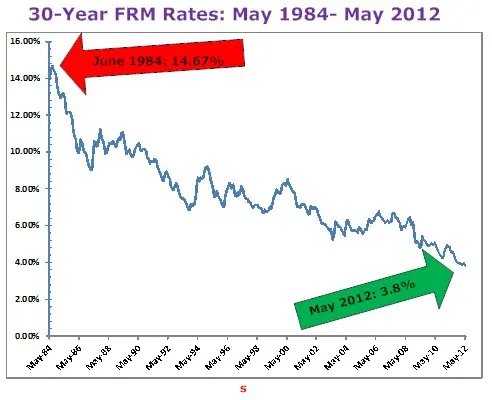

In order to get a perspective on interest rate movements, I recommend that you look at Freddie Mac’s PMMS (Primary Mortgage Market Survey), which is published once a week. The survey included average interest rates for a number of mortgage products, including 30-year FRM, 15-year FRM, and 7/1 ARMs. Freddie Mac’s tables include national and regional average rates and points. Remember, these are averages and vary.

The Chart below, taken from the PMMS data shows you interest rate movements over a 18 year period:

Today’s Interest Rates and Tools to Help you Shop for your Loan

There is always a delay between your shopping period and your closing period. The longer you wait the more chance that rates will be different. Whenever you are shopping for a loan, remember that there are different stages:

- Gathering Preliminary information

- Getting quotes

- Receiving pre-approvals

- Setting up the loan and receiving a rate lock.

In order to help you shop around for mortgages and receive today’s market rates, Bills.com has two great tools for you:

Mortgage Refinance Calculator: The mortgage refinance calculator takes you through three steps:

- Your Current Loan terms: Original loan value, date, interest rate.

- Your House: Value and location

- Your Goals: Low monthly payment, Pay off early, etc.

You will receive an analysis of a mortgage loan best suited to your needs, based on current mortgage rates. You can view a recommendation based on the amount of time you expect to hold on to the loan.

Mortgage Affordability Calculator: The mortgage affordability calculator helps you figure out the maximum amount of loan you can take based on the following criteria:

- Your Income

- Your monthly debt

- Your anticipated property tax and property insurance

- Your down payment

The calculator will give you a price range of affordable housing and mortgage payments based on conventional loan DTI ratios and current mortgage rates for a 30-year fixed rate mortgage. Remember this tool is to help you get a preliminary picture.

Quick tip

if you are looking for today’s mortgage rates for a refinance loan, purchase loan, harp loan, fha loan or va loan, then get a mortgage quote from a bills.com mortgage provider.