- High Loan to Value 30-year FHA mortgages since June 2013 have Mortgage Insurance that doesn't expire.

- Home prices throughout the US have increased enough to allow many borrowers to get rid of mortgage insurance.

- Check out two reasons to refinance an FHA loan into a conventional mortgage.

Two Reasons to Switch from an FHA to a Conventional Mortgage

Maybe you were one of the many borrowers who took out an FHA purchase loan. After the 2008 Housing Crisis FHA purchase loans become a popular alternative due to lower credit score requirements, and the possibility of making a small down payment, as low as 3.5%.

According to the U.S. Department of Housing and Urban Development FHA Single-family Market Share Report from 2019 Q1, FHA loans comprised about 30% of purchase loans in 2009-2011 and close to 20% of purchase loans between 2016-2018.

However, due to low-interest rates and rising home prices, there are two great reasons to refinance from an FHA loan to a conventional mortgage:

- Lower Your Monthly Payment and Put Cash in Your Pocket

- Lower Your Interest Rate and Save Big Money

FHA Loans: Rising Home Prices - Get Rid of your Mortgage Insurance

All FHA loans require Mortgage Insurance, which can be a drawback due to either high premiums or no cancellation policies.

According to HUD Mortgagee Letter 2013-4, since June 3, 2013, there is no cancellation of Mortgage Insurance on FHA loans with a term greater than 15 years and a loan-to-value (LTV) over 90%. For loans with those conditions, Mortgage Insurance Premiums (MIP) was raised in April 2013 to 1.35%.

Shop for a Conventional Mortgage

FHA premiums were very slightly raised in 2013. FHA premiums were lowered in 2015 and again in 2017. When refinancing, it is important to check the specific terms of your current loan.

In order to get a loan that fits your situation get a mortgage quote from a Bills.com mortgage provider.

If, for example, you took out a loan in June 2013 with an LTV of 96.5%, then your LTV would currently be about 90%. With an LTV of 90%, you could not refinance into a conventional loan without Private Mortgage Insurance (PMI). Conventional loans require an LTV of 80% or less to refinance without PMI.

However, due to rising home prices, your current LTV might be much higher than that of your originally scheduled loan. Sam Khater wrote in his Core Logic blog on March 2, 2017, that, "An Estimated 250,000 Expected to Refinance from FHA to Conventional in 2017". He further wrote:

Since January 2013, the CoreLogic Home Price Index for the U.S. has risen 30 percent as of December 2016.

Reason #1: Switch from FHA to Conventional - Lower Your Payments

If your home value has risen anywhere close to the national average, then your LTV will make you eligible for a conventional loan without mortgage insurance.

If you are looking to refinance your loan into a mortgage rate that is lower (or even slightly higher) than your current rate, you might still be able to save money because you will be able to knock off the mortgage insurance payments. Also, by extending your loan, you will decrease your monthly payment.

Scenario #1: Lower Your Payment

Let’s say that you purchased a $238,000 home in April 2016 and took out a $230,000 30-year Fixed-Rate FHA loan @ 4.37%, with monthly payments of $1.148, and MIP at 1.35% for the entire life of the loan, with a monthly MIP payment starting at about $259 (and currently about $240). Your balance as of July 2020, would be about $213,768. If your home has appreciated by just 12%, you would not require PMI on a conventional loan.

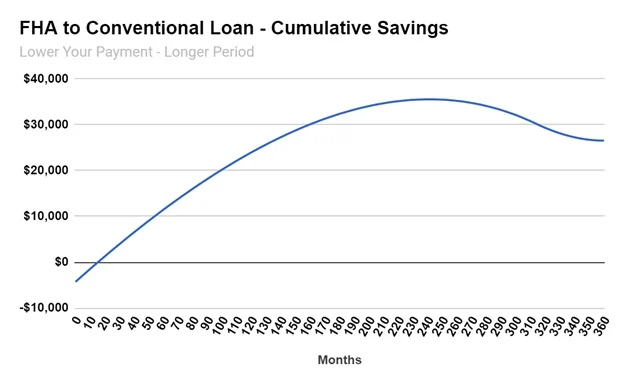

If you now take out a conventional 30-year FRM at a rate of 4.13% based on mortgage rates for July 9, 2013), with a total of 2-points of fees (lender and third party), then your potential savings would be as high as $35,316. Based on those upfront fees, your breakeven point would be after 15 months. Check out the graph below to see how much you can save during the life of the loan. Remember, if you are planning on selling the home or paying off the mortgage in the first 18 months, then a refinance might not be best for you.

Your monthly payments would also decrease by as much as $352. This amount would slightly decline each month as the FHA premium is readjusted annually. Also, you will be extending the loan for an additional four years.

If you need extra money, then the lower monthly payment, together with the overall potential savings, makes it a great choice to switch from your FHA loan to a conventional loan.

Reason #2: Switch from FHA to Conventional - Save Money

FHA loans combined low down payments with more relaxed credit requirements. With the demise of the sub-prime market after the Great Depression of 2008, many borrowers took an FHA loan because they either had a lower credit score or a high debt to income ratio (DTI).

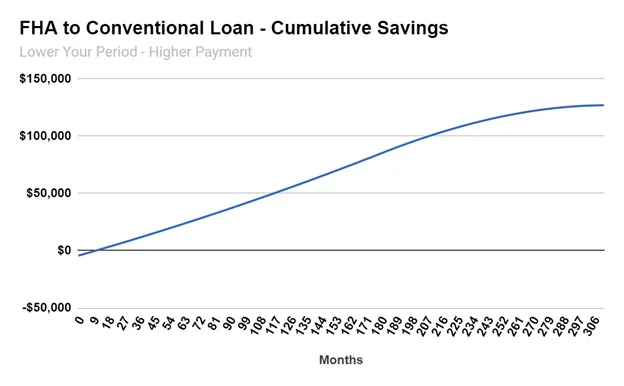

If you could increase your monthly payment a bit, it is possible to significantly increase your overall savings by switching your FHA loan to a 15-year Conventional FRM. Since the 15-year FRM has a lower interest rate and more aggressive payments, you will end up saving much more money.

Scenario #2: Switch from FHA to Conventional Mortgage and Save Money

Using the same original loan as shown in scenario # 1, you can now refinance your $213,768 balance into a 15-year FRM @ 3.38%, with a 2-point total fee. Your total scheduled savings would be $126,881, and your breakeven would be only about ten months. After five years, you can save over $22,000.

Even with the shorter period that knocks off nine years from your original loan, your monthly payment increases only by $127 for the first year. (As the FHA MI payments decrease the monthly payment differential will increase to about $223, until after the 15th year, during which you will have nine more years of payments to make on your original loan).

Should you refinance your FHA loan into a Conventional Mortgage?

For some borrowers, the change will create significant savings. For others, the refinance can create a lower payment. However, before you refinance, consider these factors and make sure that you can benefit from a mortgage refinance:

- Can you qualify for a conventional loan? Is your credit score sufficient? In general, you need at least a 620 FICO score.

- Do you have sufficient income, and is your debt to income ratio (DTI) acceptable?

- Has your house appreciated enough in value to bring you to an 80% LTV?

- Are you going to stay in the home long enough to make the refinance worthwhile?

- Check the details of your current FHA mortgage, including your current interest rate, FHA MIP premium, and cancellation policy. Compare them with new mortgage offers, including interest rates, lender fees, and third-party fees. Shop and get the mortgage product that fits your personal needs.