What Is A Signature Loan And How Does It Work?

Find a personal loan tailored to meet your needs

Choose your desired loan amount

Pre-qualification won’t impact your credit

- 8 min read

- Signature loans are personal loans that don’t require any collateral.

- Signature loans can be used for a variety of purposes.

- Because they lack collateral, signature loans are more expensive than secured loans.

Table of Contents

Signature loans can be appropriate when you need ready cash to cover a large expense. They are flexible, don’t require collateral and you can use them for almost any legal purpose. While they can be costly, there are situations where a signature loan may be less expensive than other credit options.

This article should help you decide if a signature loan is right for you. Topics covered include:

- What is a signature loan?

- Comparing signature loans to personal loans

- What are signature loans used for

- How to compare signature loans

- Applying for a signature loan

- Pros and cons of signature loans

What is a signature loan?

A signature loan is another name for an unsecured personal loan. That means you don’t pledge an asset – called collateral – that the lender can take if you don’t repay the loan. “Secured” loans, like auto financing ot mortgages, require collateral, while unsecured loans do not.

Personal loans are not limited to any one specific purpose – unlike mortgages, auto loans or student loans, which must be used to finance a specific type of purchase or expense. (There is one caveat, however – many personal loan providers do not allow you to refinance a government-backed student loan with their product.)

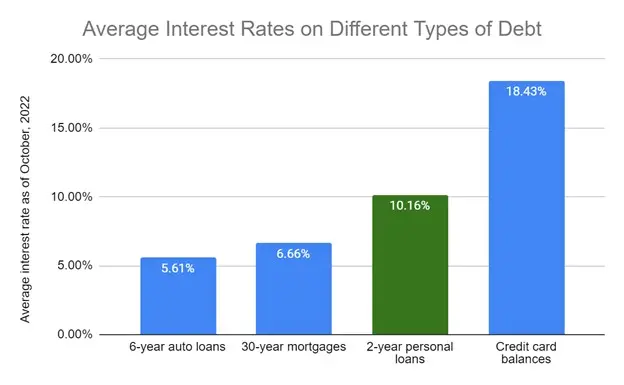

Personal loans generally have higher interest rates than mortgages or auto loans, but lower rates than credit cards. The following graph shows the average interest rates for different types of credit, according to Federal Reserve and Freddie Mac data as of October, 2022.

These rates are subject to change over time, but they demonstrate the relationship between rates on different types of loans. However, there is a wide range of interest rates for personal loans, so how cost-effective they depend on the specific situation.

Comparing signature loans to personal loans

Personal loans may be secured or unsecured. To get a secured loan, you would need to put up something of value as a guarantee that you will make your loan payments. The value of that collateral would have to be at least as great as the amount of the loan.

Signature loans are unsecured. That makes them more widely available than secured loans, because they aren’t limited to people who have collateral to put up as a guarantee. However, there are also disadvantages to getting an unsecured loan.

Because signature loans are unsecured, the lender is likely to demand a higher interest rate on them. They may also require more restrictive loan terms, such as a shorter repayment period and/or a lower loan limit.

When a loan is unsecured, qualifying for one depends a lot on the borrower’s personal financial condition. This includes things like credit score, income and amount of other debt.

Being in strong personal financial condition can improve your chances of getting approved for a signature loan. It can also qualify you for a better interest rate.

What are signature loans used for?

Signature loans have a wide variety of possible uses. Generally speaking, these are expenses that don’t involve a major purchase. If you want a loan for a major purchase, like a car, secured auto financing is much cheaper.

However, there are times when you may need money for something you can’t use as collateral. That’s when you might consider a signature loan. For instance:

- Debt consolidation. Debt consolidation means taking out a new loan and using it to pay off several debts. The new loan should have better terms – a lower interest rate or payment, for instance.

- Medical expenses. These costs can come up suddenly and unexpectedly. Personal loans generally have lower interest rates than credit cards if you need money fast.

- Travel costs. You can save on travel with signature loans by paying in advance. For instance, many cruises are discounted 50% or more if you pay 12 months ahead. However, you should try to have the loan paid off by the time you take your trip – it’s not good to finance short-term purchases with long-term loans.

- Paying for a wedding. You can use signature loans as wedding loans, but do some serious budgeting first. You don’t want to still be paying for your wedding on your ten-year anniversary.

How to compare and shop for a signature loan

If you’re thinking about getting a signature loan, contact multiple lenders and compare offers. Consider these factors when deciding on a loan:

- Interest rate.

- Loan term.

- Loan limits.

- Qualifying.

- Loan fees.

Check Interest rates

Interest rates on signature loans vary widely. You could be overpaying by a lot if you don’t compare multiple offers.

When comparing interest rates, make you you’re evaluating loans with the same terms.

Do the loan term and monthly payments fit your budget?

The loan term is the length of time you’ll have to pay back the loan.

A loan’s term is important for a few reasons. The more time you have to repay a loan, the lower your payment will be. However, that increases your interest cost over the life of the loan.

Also, loans with longer terms generally (but not always) have higher interest rates. It’s important to compare loans with the same term lengths.

Loan limits - does the lender offer the amount of loan you want?

Loan limits determine how much a lender allows customers to borrow. There are two kinds of loan limits – a maximum amount that no one is allowed to exceed, and maximum amounts for applicants based on their qualifications.

When looking for a lender, it helps to start by seeing which ones lend the amount of money you’re looking for. Beyond that, pay attention to whether they have different limits for different credit score tiers.

Can you qualify for the loan?

Since there is no collateral with a signature loan, your credit history is especially important.

Signature loans are much harder to get if your credit isn’t excellent. That’s because the only security for a lender is your promise to repay the loan, and your credit rating indicates how likely you are to keep that promise.

Even if you can get a signature loan with poor credit, the interest rate is likely to be very high -- above 30% in many cases. However, people with better credit scores should be able to find signature loans at much more reasonable terms.

Are there any origination, prepayment or monthly fees

Fees can be a major cost of borrowing along with interest rates.

The tricky part is that fees come in a lot of different forms. These may be called application fees, origination fees, closing fees or other names. However, the names don’t matter – the bottom line does. The loan’s annual percentage rate, or APR, includes the loan’s interest and fees, which makes it easier to compare loans with varying rates and fees.

Just make sure that you analyze loans with the same term and loan amount or the comparison won’t be valid.

Applying for a signature loan

To compare loans with similar terms and conditions, determine how much you want to borrow and how long you need to repay the loan. Look for lenders that offer that loan amount and term.

You should also check your credit score, because this will go a long way towards determining which loan offers are available to you.

Many lenders offer prequalification online. You just answer a few questions and you can get a preliminary offer. Make sure that prequalifying will not require a “hard pull” of your credit, which drops your credit score.

Prequalification doesn’t result in actual approval for a loan. What it does is give you an idea of the specific loan offers that may be available to you from a particular lender. That allows you to narrow down your search before you start formally applying to lenders. Compare preliminary offers, then apply with the lender that offers the best terms.

When you decide which lender you want, you’ll probably have to authorize a credit check and employment verification. The lender validates the information you supplied and makes a formal underwriting decision. The entire process – from application to approval to funding – usually takes only a few days.

Pros and cons of signature loans

- The chief advantages of signature loans are their wide availability and their flexibility.

- Signature loans are helpful for people who can’t or don’t want to put up an asset as collateral.

- Since signature loans are not tied to a particular piece of collateral, you have the flexibility to use them for any purpose that suits you.

- Because there’s no collateral on a signature loan, they can cost a great deal more than a secured loan.

- People who’ve had credit problems in the past should consider whether an expensive loan would just add to their financial difficulties.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Get your personalized offer

Choose your desired loan amount

Pre-qualification won’t impact your credit

Signature loans vs. personal loans: What is the difference?

Signature loans are unsecured personal loans. A signature loan doesn’t require any collateral. Secured personal loans require collateral.

Signature loans vs. secured loans: Which is better?

A secured loan requires collateral. Your property isn’t directly at risk if you’re unable to repay the loan. This makes them less risky for borrowers but riskier for lenders. Because of this risk, signature loans are typically more expensive than secured loans.

What credit score is needed for a signature loan?

Most signature loans require good-to-excellent credit (620-680 and above), although some lenders allow lower credit scores. However, if you see an ad for a signature or personal loan “for bad credit” or with “no credit check,” it’s almost always actually a payday loan, cash advance loan or title loan. And those are traps with high fees and interest rates that average about 400%.