Budget Guide - Creating a Personal Budget

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 6 min read

Creating a Personal Budget and Identifying Your Bills

| Bills.com Budget Guide |

|---|

| The Need for a Budget |

| Creating a Personal Budget |

| Your Budget Worksheet |

| Analyze Your Cash Flow |

| Eliminating Unhealthy Debts |

| Setting Long Term Goals |

| On the Road to Financial Freedom |

Understanding your financial situation – looking into the money mirror

One of the first steps toward financial freedom is to understand how much money comes in and goes out of your household every month, what is called your “cash flow.” Your cash flow is a factor of how much comes in as income and how much goes out as expenses. Hopefully, you have much more coming in than is going out… and if you don’t you may need to make some quick changes. Start by creating a Personal Monthly Budget Worksheet (link provided below). Your worksheet breaks down your income and expenses by financial categories, providing you with a snapshot of your entire cash flow picture.

Download the Bills.com Budget Worksheets

Creating a projected budget

Familiarize yourself with the budget worksheet and review the categories listed. You will see that there are a series of main categories and then specific expenses listed within the categories. There are also categories for gross income and taxes on income. Some of your expenses will be the same every month and some will vary. This is one reason why creating and keeping a budget is an ongoing project.

Your projected budget lays out how you want to allocate your money each month. Keep in mind how much you spend on each category. Ideally, your projected budget will not be in the red, or negative, at the end of the month. You should also include provisions for emergencies and savings as well as account for any bills that are not paid monthly, but annually, e.g., insurance and property tax. If you are unsure, then set up a preliminary short-term budget for a three month period. After reviewing your results, you can proceed to a yearly budget.

While it is ideal that you have complete records to review, do not be discouraged if you have incomplete records. You can start keeping thorough records from today onward. Keeping good track of your expenses is not always quick, but it is a crucial step. If you are experiencing financial difficulties, it can be depressing to even look at your bills, but you need to face this challenge. Things are not going to get better unless you take the right steps to make them better.

Identify Your Actual Bills

One way to examine your bills is to break them down into fixed monthly expenses and variable expenses. Examples of your fixed expenses include rent or mortgage, health insurance, a car payment, and some utilities. The costs for these expenses typically do not change significantly month-to-month. If possible, you should budget enough of your income to pay off these items each and every month.

If you are unable to cover your basic, fixed expenses, you are facing serious financial trouble. If the only way you are covering your fixed expenses is to run up credit card debt, you should consider debt relief solutions such as credit counseling and debt settlement. Some fixed expenses are unnecessary, such as Cable TV, and you may need to eliminate them to stabilize your financial ship.

Second, identify your variable expenses. These expenses fluctuate month-to-month. Variable expenses include food, clothing, gasoline, and entertainment costs. In contrast to your fixed costs, your variable costs are easier to work on reducing, so you can increase your cash flow. While certain fixed costs such as your rent/mortgage or car payment can be reduced, doing so requires a radical change. You could move to a cheaper residence or replace your car with a less expensive one or even do without a car. Reducing variable expenses on the other hand mostly requires discipline and smaller adjustments that don’t typically result in dramatic lifestyle changes.

Get started by setting the appropriate monthly budget for each category. When setting your budget for each category, you should consider whether what you are buying is a luxury or a necessity. Really question yourself whether you need it or not. Water is a necessity, but do you need to spend money on bottled water? Even when it comes to something that you define as a necessity, shop around to get the best deal. Every dollar you save is important. Some quick tips are to shop around and compare prices, don’t grocery shop when you are hungry (you’ll want to put everything into your cart), and use third party sites like Bills.com or Billshrink.com or Home-Account.com to compare and reduce your expenses on things like cell phones, cable, and insurance. If you have a mortgage, see if you can refinance to a lower rate and always compare the lifetime true cost of a loan, including any points or fees incurred.

Next, rank your necessity expenses from most important to least important. Allocate your income first to the items you need the most and the ones that are the most important to you. Do not set a budget for your luxury items for now.

Once you have allocated your income to all the necessary expenses, determine how much you would like to save per month into a savings fund for future use and for building wealth. It’s recommended that you save at least 10% of your income to build your net worth. You should also aim to build a rainy-day fund. Money in your rainy-day fund can be used for any emergency situation that arises, such as an accident or unforeseen medical expenses, or for some annual bill that you did not account for in your budget worksheet. Finally, allocate any remaining budget to your luxury expenses such as a gym membership, entertainment, dinning out, etc.

As you are creating your budget, keep in mind that a budget is a tool for you to develop a solid financial strategy and to develop positive cash flow.

Allocate Your Money Wisely

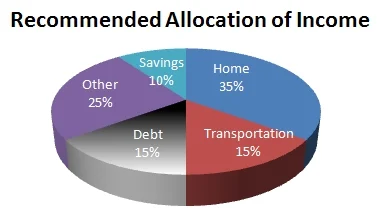

To help you determine how to allocate your income, here is a general guideline on how your household expenses should break down. The chart below shows percentages for each of the five major categories: Home, Transportation, Debt, Other, and Savings. To calculate the recommended spending amount in dollars, multiply each expense percentage by your net income. A good rule of thumb is that expenses should break down approximately as follows:

If you allocate more on a particular category, review your expenses in that category and consider if there is room for you to cut back. You will not be able to easily reduce all your expenses. Generally speaking, you should first look to reduce spending on items that are not considered necessary. If you are way out of line in a big category like “Home” or “Transportation” you may want to do a gut check and even talk with a financial mentor or advisor to see if downsizing, moving, or getting a less expensive car are good ideas.

Back: The Need for a Budget Next: Your Budget Worksheet

Download the Bills.com Personal Budget Guide & Budget Worksheets

Get the full printable Bills.com budget guide:

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836