Credit Report Codes at a Glance

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- Equifax, Experian, and TransUnion, share but not all reporting codes.

- Learn how each credit bureau reports delinquent accounts.

- Bookmark this page to find this handy resource.

- Start your FREE debt assessment

My Credit Report Contains a Code I Can't Figure Out. Can You Help?

My car was repossessed in November 2011. I had one year of payments left on a 6-year loan. A few weeks later, I received a check for $500 from HSBC, the lender. I assumed that was because the car was auctioned for over the principal amount of the loan outstanding. I have never received any bills or letters stating I owed any more. I recently checked my credit on Experian, and saw that HSBC keeps reporting "KB" for that loan. What should I do?

Here is a table containing known codes that appear on credit reports:

| Common Credit Report Codes | |

|---|---|

| Code | Description |

| Blank indicates no data reported | |

| 0 | Not rated, too new to rate |

| 1 | Equifax: As agreed Experian: 30 days past due TransUnion: As agreed |

| 2 | Equifax: 2 payments late Experian: 60 days past due TransUnion: 30-59 days late |

| 3 | Equifax: 3 payments late Experian: 90 days past due TransUnion: 60-89 days late |

| 4 | Equifax: 4 payments late Experian: 120 days past due TransUnion: 90-119 days late |

| 5 | Equifax: 120+ days late Experian: 150 days past due TransUnion: 120+ days late |

| 6 | Experian: 180 days past due |

| 7 | Equifax: Wage garnishment Experian: Chapter 13 bankruptcy TransUnion: Wage garnishment |

| 8 | Equifax & TransUnion: Repossession |

| 8A | Voluntary repossession |

| 8D | Legal repossession |

| 8R | Redeemed repossession |

| 09 | Charged off to bad debt |

| 9B | Collection account |

| 9 | Discharged in bankruptcy, or Charge off |

| 13 | Chapter 13 bankruptcy |

| A | Authorized user on the account, or Inactive, or Automated date, or Automotive business classification |

| B | Experian: Account condition change TransUnion: Lost/stolen cards Bank business classification |

| C | Account is current, or Co-signer on account with payment liability, or Line of Credit account, or Date closed, or Clothing business classification |

| D | Declined date, or Refinances, or Dept. Store business classification |

| E | Deceased, or Employment business classification |

| F | Repossessed/Written Off/Collection date, or Financial counseling, or Personal finance business classification |

| G | Account in collection, or Grocery store business classification |

| H | Wage garnishment from someone other than the account holder, or Foreclosure, or Home Furnishings business classification |

| I | Individual account, or Installment account, or Indirect date, or Insurance business classification |

| J | Voluntary repossession, or Joint account, or Jewelry, camera, Computer business classification, or Pending adjustment |

| K | Experian: Repossession, or Contractor business classification |

| L | Charge off or write-off, or Lumber/Hardware business classification |

| M | Maker of the account, or Maker of account with co-signer who shares liability, or Mortgage, or Manually frozen date, or Medical business classification, or Chapter 13 filing |

| N | Current, zero balance & no updates from creditor, or No record date, or Credit card/Travel/Entertainment business classification |

| O | Current, zero balance & updates from creditor, or Oil Company business classification |

| P | Participant in shared account that cannot be distinguished as C or A, or Paid-out date, or Personal Services business classification |

| Q | Finance Company business classification |

| R | Revolving account, or Reported date, or Real Estate business classification |

| S | Shared account, or Slow answering date, or Sporting Goods business classification |

| T | Account terminated, or Temporarily frozen date, or Farm & Garden Supplies business classification |

| U | Unknown account ownership responsibility, or Utilities & Fuel business classification |

| UC | Unclassified |

| UR | Unrated |

| V | Verified date, or Government business classification |

| W | Wholesale business classification |

| X | Deceased, or No reply date, or Advertising business classification |

| Y | Collection business classification |

| Z | Miscellaneous business classification |

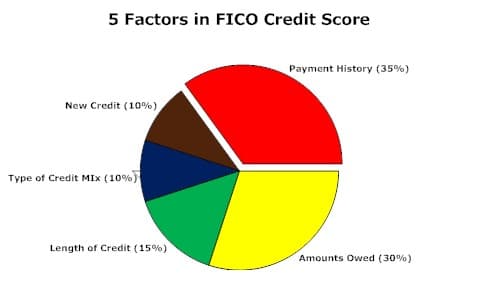

Credit Score Codes

You mentioned Experian. According the information we could find about Experian’s reporting habits, a "K" indicates a repossession. A "B" in Experian-speak signifies an account change. We could not find a "KB," however, even in this Experian Glossary of Account Conditions and Payment Status (PDF). Therefore, we cannot say what KB means, and how it varies from an ordinary K.

Quick Tip

Debt causing you distress? Bills.com can match you with a pre-screened debt resolution provider.

Credit Reporting

Under the Fair Credit Reporting Act, most derogatories, including repossessions, can be reported on a credit report for 7½ years. You mentioned the repossession occurred in November 2011, which means it will be reported until late 2018 or early 2019.

You asked what to do. At this point, you have little leverage with the creditor to ask it to remove the derogatory from your credit report. One option is to contact someone in authority at the vehicle loan unit at HSBC and ask for a "goodwill" deletion of the derogatory. It may do so to try to win you over as a customer, or it may ignore your request. It has no legal obligation to honor your deletion request.

If a goodwill request fails, then you will have to work on building the positive aspects of your credit report so that these outweigh your negative. See the Bills.com article 7 Techniques to Improve Your Credit Score to learn how to add muscle to your credit report.

I hope this information helps you Find. Learn & Save.

Best,

Bill

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836