Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- The laws governing medical billing vary between states.

- Contact the medical service provider to set up a payment plan.

- Start your FREE debt assessment

Need some advice on how to reach a payment agreement for hospital bills.

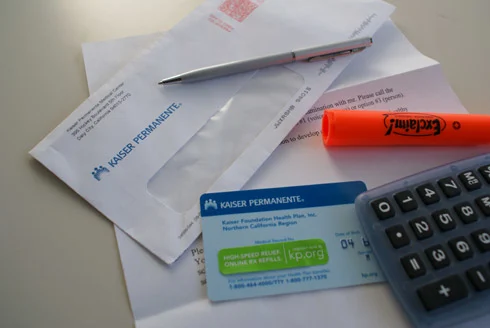

I have been temporarily laid off and called a hospital that I have been making regular payments to in order to make new payment arrangements with them. I was sent a lengthy form which I was told I must fill out in order to get any kind of extension or refinancing at all, even temporarily. These forms ask for very personal info, even my bank acct. number! I was shocked. Can they legally require this information from me? Any advice is appreciated. Thanks.

The laws governing hospital billing and payments vary greatly between states, counties, and cities, and may apply differently depending on whether it is a private or public hospital, as well as other factors. To find out the specifics regarding the legality of the hospital’s requests, you would need to consult with a qualified attorney with knowledge of pertaining laws in the hospital's jurisdiction.

That said, many hospitals have a financial counselor/financial assistance office where you can meet with someone face-to-face or over the telephone to discuss your situation. You should feel free to ask them why they request specific information and if they will accept alternatives. You might want to keep in mind that some hospitals allow their financial assistance office a certain degree of latitude in evaluating hardship cases, so engaging them in a polite and courteous manner may help you as you negotiate your case.

When having problems regarding medical bills, the American Academy of Family Physicians recommends the following:

- Notify the appropriate offices quickly.

- Keep in touch with your creditors.

- Record the names and phone numbers of who you are dealing with.

- Document the date, time, and results of your phone calls.

- Pay something — even a small amount — on each bill each month as a gesture of good faith.

I would also encourage you to download our free Personal Finance Budget Guide. It may help you plan your money management as you navigate the road ahead.

Good Luck,

Bill

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836

Recommended Reads

10 Comments

If the charges are reasonable, then depending on your state's debt laws, yes, a judgment-debtor may have the right to place a lien on your real property. Consult with a lawyer in your state who has experience in civil litigation or medical malpractice to learn more about your rights.

I can't give you an estimate for the size of the monthly payment that the hospital will accept. I can tell you that, in a worst case scenario, an unpaid debt could lead to a lawsuit, judgment, and collection efforts that include wage garnishment, bank levy, and a lien against you. Even if a lien is filed and would need to be paid if you sold the home, the odds that it could lead to you losing your house are astronomically small. I have not heard of a case where a homeowner is forced to sell her home for a few thousand dollar debt.