Renting Can be More Affordable

- Affordability is a main driver for renting.

- Lifestyle is the second main reason for renting.

- Follow local trends in the home market.

Can’t Afford to Buy? How About Renting

There are a number of reasons to rent instead of buying. Maybe you have too much debt? High student loan payments make it impossible to save money for a down payment? Or maybe you just prefer to live in the city next to all of your favorite activities?

Buying a home and taking out a mortgage takes a commitment. Your home mortgage is a constant monthly payment that has fierce consequences if not paid on time. Many households prefer renting instead of buying. The number two reasons are affordability and lifestyle preferences.

Freddie Mac recently did research about the renter profile and reasons households prefer to rent. They discovered that,

"...despite growing economic confidence among renters, affordability remains dominant in driving renter behavior.

Householder Sentiment - Is it A Good Time to Buy or Rent?

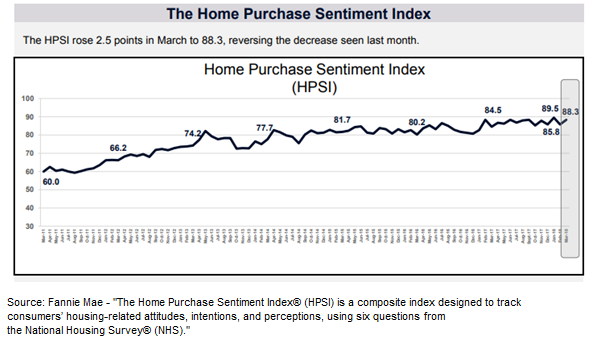

The other big player in the housing market, Fannie Mae, monitors consumers attitudes regarding mortgage and housing markets. They created the Fannie Mae Home Purchase Sentiment Index® (HPSI), based on six questions to measure how consumers feel about buying a home.

Their monthly National Housing Survey centers around six questions and is based on the next results of each question:

- Good Time To Buy

- Good Time To Sell

- Home Prices Will Go Up (next 12 months)

- Mortgage Rates Will Go Down (next 12 months)

- Confidence About Not Losing Job (next 12 months)

- Household Income Is Significantly Higher (past 12 months)

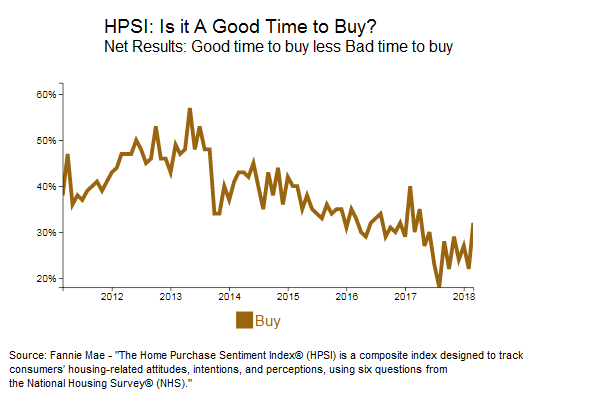

The March HPSI was in line with the overall trend of households seeing the housing market and personal financial situation in a positive light. When asked if now is a good time to buy a home “The net share of Americans who say it is a good time to buy a home rose 10 percentage points to 32%.”

According to the Fannie Mae Press release, Doug Duncan, senior vice president and chief economist at Fannie Mae summed up that the positive sentiment regarding buying a home was a prime reason for an increase in the March 2018 HPSI, and that,

“On the whole, a slight majority of consumers continue to express optimism regarding the overall direction of the economy.

However, there is still a sizeable amount of householders that either doesn’t feel that it is a good time to buy, or they can’t afford to buy. Many households still feel that even their economic situation is improving, the prices of home are going up at a fast pace and buying a home isn’t affordable.

Renter Affordability: A Deeper Dive

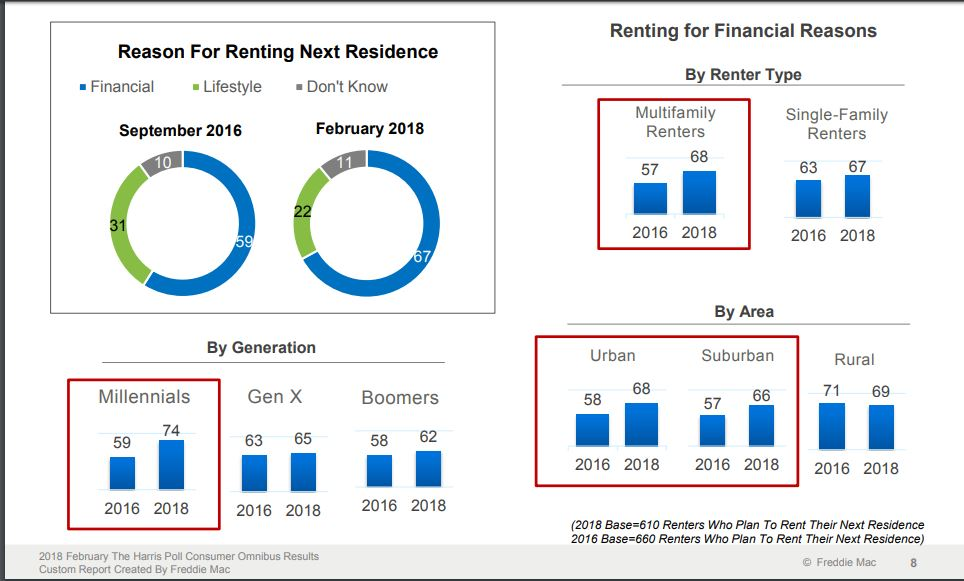

Freddie Mac’s March 2018 results show that affordability is a key issue among renters. The spring "Profile of Today's Renter" found that:

“...a total of 67 percent of renters view renting as more affordable than owning a home, including 73 percent of Baby Boomers (aged 53-71). Similarly, 67 percent of renters who will continue renting say they will do so for financial reasons—up from 59 percent just two years ago.

Financial Reasons or Lifestyle

The most common response for renting the next residence is financial reasons. In September 2016 31% of respondents noted that lifestyle was the main reason, whereas only 22% saw that as the main reason. When looking at the differences between groups, note that financial reasons for renting are most prominent among millennials, with 74% of millennials renting due to financial reasons compared to 62% of baby boomers. There were no significant differences between renter types or area (urban type).

Future Affordability: Renting and Buying - Do More Renters Believe Buying a Home Will Become More Affordable?

The Freddie Mac survey also checked to see future expectations regarding buying affordability. While 20% believe that buying a home would be more affordable in the future, 31% said that it would be less affordable. Almost a quarter of respondents don’t know if are not sure. This contrasts with the view regarding renting affordability, where half of the respondents feel that it will remain the same.

Renting vs Buying: Which Direction

Buying a home is a very personal decision. Not only do you need to consider the financial aspects of buying a home, but you must also consider how buying or renting fits into your lifestyle.

With a shortage of homes in many parts of the country, buying a home is not affordable. However, the pressure on renting a home is strong, and many households feel that rental prices are going to go up in the next 12 months.

If you are considering purchasing a home, then it is important to prepare your finances, save money for a down payment, improve your credit and get pre-approved for a home purchase mortgage.

Rent or Buy?

Are you considering buying a home? Get pre-approved for a mortgage. Get a mortgage quote now from a Bills.com mortgage provider.