Higher Rates - Grab Your Refinance While You Can

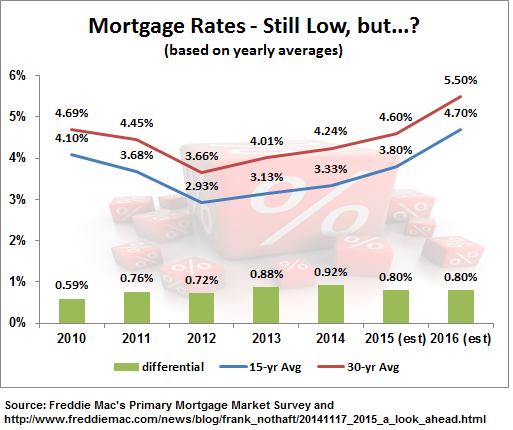

Mortgage rates are still low, which is excellent for anyone looking to refinance. However, low-interest rates are not here to stay, at least, according to Freddie Mac's Chief Economist, Frank Nothaft. In Freddie Mac's November 2014 Outlook, he predicts that 30-year mortgages will reach 4.6% during 2015 and 5.5% by the end of 2016.

Check out the movement in interest rates since 2010, including estimates for 2015-2016.

Our recommendation is to keep updated on interest rates. Rates rise and fall, so it pays to keep track of rates. In less than two minutes, you can check rates whenever you want, by using the Bills.com mortgage rate table. You aren't asked for your name, phone number, or email address, so you can monitor rates, without receiving calls.

Based on Freddie Mac’s Primary Mortgage Market Survey (PMMS) 30-year mortgage rates as of January 8, 2015 are still very low at about 3.73%. 15-year mortgage rates are even much lower, at about 3.05%.

Even a 4.6% rate is low by historical standards. If you can afford higher payments, then you can save more by refinancing into a shorter-term loan such as a 15-year mortgage with even lower rates.

Higher Home Prices – More Refinance Opportunities

According to the Freddie Mac House Price Index, home prices increased by about 20% between 2012-2014.

Nothaft predicts that home prices will show moderate increases during 2015 and 2016. After the 2007-2008 housing crash, home prices plummeted making tens of millions of homeowners underwater mortgage borrowers.

The HARP program allowed relief for eligible Fannie Mae and Freddie Mac mortgage loans (pre June 2009 mortgages). Over 3 million HARP loans were taken between 2009-2014. There are an estimated 800,000 more eligible borrowers who can benefit from the low interest rates. (The HARP program expires in Dec. 31 2015).

However, there are millions of underwater borrowers, who did not qualify for the HARP program. With no HARP 3 program in the works, the only real solution to refinance is for their equity position to improve.

The good news is that with higher prices, there are more refinance opportunities. In fact, as home prices increase and borrowers loan to value decreases many borrowers can refinance without using mortgage insurance. (Conventional loan with a LTV of 80% or less does not require private mortgage insurance).

More Refinance Opportunities: Lenders Ease Requirements

Although the sub-prime market is nearly extinct, there are lenders who are easing their credit requirements. Some lenders are now willing to offer conventional loans with just a 620 FICO score. There are some lenders offering FHA loans, which come with mandatory mortgage insurance, to borrowes with FICO scores as low as 580.

Refinance While You Can – Check Your Finances

The Great Recession adversely affected many borrowers. Job termination, reduced hours and a cut in pay, lost savings, or a drop in their credit score, are just some of the negative economic consequences people suffered.

However, along with an improving housing market, the economy has shown improvement in many areas. An improvement in your credit score (and any old item becomes less significant over time) and/or an increase in your stable income are two ways that you can bolster your chance to qualify for a refinance.

Here are three ways you should check your finances:

- Credit Report (and Score): If credit scores are an issue, then monitor your credit report. If you find inaccurate information, make sure you remove it. Also, take all the right steps to improve your credit, especially making all your payments on time.

- Budget: Keep an accurate monthly budget. Pay special attention to your monthly debt payments. Before you refinance, calculate your income. Lenders look at your stable, documented income.

- Savings: Are you saving enough money? Do you have a healthy emergency fund? Sit down and make sure that you are allocating enough money to your retirement and investment accounts.

Bills Action Plan – Refinance While You Can

Today’s low market rates are a great reason to look into refinancing. We predict that rates will increase during 2015 and continue to do so throughout 2016.

In order to best take advantage of the low rates take these steps to find the best refinance opportunity for your home:

- Check out today’s mortgage rates and stay on top of how rates are fluctuating.

- Consider increasing your savings by taking out a 15-year mortgage. Rates are lower on 15-year loans. If you can afford the payment, it can be a great way to save money and pay off your mortgage faster

- If your primary goal is a lower monthly payment, consider refinancing into a 30-year loan. However, by restarting the clock on your loan extending your loan term you will increase your overall costs.

- Adjustable-Rate Mortgages are a good choice for some borrowers, especially borrowers who are confident that they will sell their home within 5 to 7 years.

- Do a thorough financial analysis. Pay special attention to your income and how much you spend each month for your minimum required debt payments.

- Monitor your credit report. Dispute any inaccurate items that appear, as they harm your score and can be removed.