- Refinancing your mortgage into a low interest rate can save you money.

- Many people refinance their mortgage into more affordable payments.

- Refinancing a mortgage can also create a more stable payment.

Refinance Your Mortgage – More than One Reason to Refinance

Sure, most people who refinance look to save money; however, refinancing isn’t just about rates.

Mortgage borrowers looking to improve their financial situation need to keep abreast of changes in mortgage rates. Before you refinance your mortgage, shop around and find the deal that best fits your financial situation. Mortgage rates (and the difference between your current mortgage and real-time mortgage rates) are going to make a big difference.

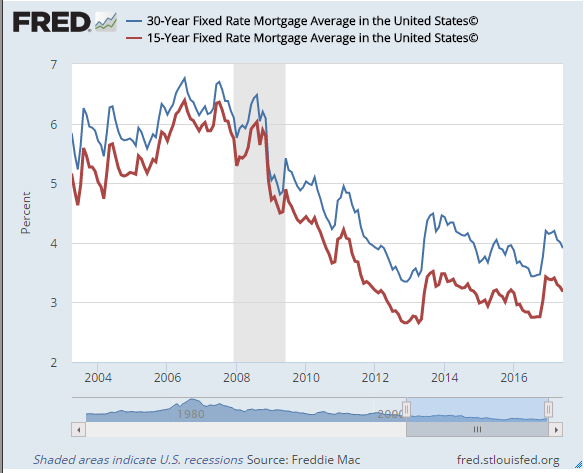

Check out the chart below to see how mortgage rates, both 15-year and 30-year fixed rate mortgages (FRM) have changed. The data is taken from Freddie Mac’s Primary Mortgage Market Survey.

Source: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States© [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, June 21, 2017. And Freddie Mac, 15-Year Fixed Rate Mortgage Average in the United States© [MORTGAGE15US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE15US, June 21, 2017.

Refinance Your Mortgage - Get a Quote Now

Looking to refinance your mortgage? Whether you are interested in building equity, take out cash, or save money, shop around for a mortgage quote.

Refinance Your Mortgage - Choose the Right Reason(s)

However, besides the obvious reason of lowering your interest rate and saving money, here are some other major reasons and methods borrowers refinance their mortgage:

- Get cash - Tap into equity ( consolidate debt, pay for college etc) through a cash out refinance or Home Equity Loan

- Accumulate wealth - Take a short term Fixed Rate Mortgage (FRM) for 4-15 years and shorten the repayment period

- Make your payment more affordable - Take a 30-year FRM and lengthen your repayment period

- Get a More Stable Product - Take a FRM and get out of an Adjustable Rate Mortgage (ARM) or balloon payment.

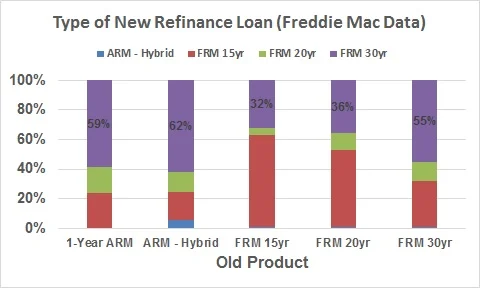

Freddie Mac publishes a monthly (and quarterly) refinance report, with statistics regarding industry trends. One thing we can all learn from their report is that there is more than one reason to refinance your mortgage.

Freddie Mac offers a glimpse into the transition behavior of mortgage refinance borrowers. (What kind of refinance loan do they choose to replace their original loan).

Here are some conclusions:

- Nobody refinanced into a balloon or 1-year ARM.

- Fixed rate mortgages (FRM) were popular across the board.

- Many borrowers who had shorter-term loans, refinanced into a 30-year loan; however, most choose to refinance into a 15-year loan.

Four Reasons to Refinance Your Mortgage

Reason #1 to Refinance: Get Cash

Maybe you need cash to pay for a college education? Or, you have built up credit card debt, or medical expenses? If you have built up equity, either through paying off your mortgage significantly and/or rising home prices, then a cash-out mortgage might be a possibility. Although a long-term mortgage is not always the best way to consolidate debt or pay for big-ticket items, it is one debt relief solution that offers both lower interest rates and lower monthly payments.

Reason #2 to Refinance: Accumulate Wealth – Pay Your Mortgage Quicker

A short term loan allows you to build up equity in your home. A lower interest rate coupled with aggressive payments allows you to save tens of thousand of dollars on your mortgage.

Reason # 3 to Refinance: Make Your Loan More Affordable – Lower Your Payments

Increasing the monthly mortgage payment is not for everyone. Some borrowers can’t afford their monthly payments, or wish to reduce their payments in order to cover other monthly expenses. Obviously, over the long-run term, you will pay much more interest. However, by stretching out your loan, you will gain two big benefits:

- Your monthly payment will decrease.

- With today’s low rates, you may possibly have a lower interest rate and therefore save on your interest costs (at least for part of the loan).

Reason #4 to Refinance: Get out of a Variable Rate Loan

During the pre-housing bust of 2007-2008, many borrowers took out higher risk loans, such as Adjustable Rate Mortgages, balloon loans, or interest only loans. Although these are a small proportion of existing loans, they are very rare in today’s low interest and tight credit market. However, based on on Freddie Mac’s data for Q1 2017 about 60% of borrowers with ARMs refinanced into Fixed Rate mortgages. Today’s low interest rate market makes a fixed rate mortgage a good choice for borrowers who want to avoid the risk of an adjustable interest rate and larger monthly payment.

Mortgage Refinance - Get a Quote Now

Looking to refinance your mortgage? Whether you are interested in building equity, take out cash, or save money, shop around for a mortgage quote.