- The CFPB will disclose the Qualified Mortgage Rules in early 2013.

- The QMR will affect the availability and price of mortgage loans.

- A tight definition of the ability to pay rule will discourage private lenders.

Qualified Mortgage Rule - Protecting Consumers, But...

January 2013 Update:

On January 10, 2013, the Consumer Financial Protection Bureau (CFPB) published their Qualified Mortgage and Ability to Repay Rules. The new rules will not go into effect until January 2014, so lenders have time to prepare for the changes. The CFPB is also seeking comments from consumers regarding adjustments and amendments to the rules, including exemptions for special homeownership stabilization programs (like the Making Home Affordable programs), non-profit creditors, and small creditors, community banks and credit unions that hold the loans in their own portfolios.

The Qualified Mortgage Rule (QMR) rule will determine which loans are considered less risky mortgage loans.

- Consumers: The QMR is intended to protect borrowers from predatory lending.

- Lenders: Mortgage disclosures will become even more important.

Lenders and Borrowers: Stay Tuned! Bills.com will continue to follow and update you on the QMR.

Borrowers: What does the QMR Mean for You?

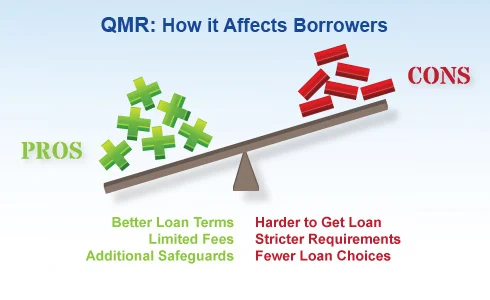

It is clear that lenders need to prepare for the Qualified Mortgage Rule (QMR), by preparing better and clearer disclosures, cleaning up their underwriting practices, and avoiding high-risk loans. However, it is less clear what the QMR and ability to repay rules will mean to you, the borrower?

Here are some of the pluses and minuses of the Qualified Mortgage and Ability to Repay Rules:

- Fewer Loan choices: Since qualified mortgages are less risky loans, you will have fewer repayment term choices. Interest only, negative amortization and balloon payments are out. There are also limitations on teaser rates and hybrid Adjustable Rate Mortgages.

- Limited Fees: The QMR limits fees to 3% of the loan total. However, it is not yet clear which fees will be included. For example, third party fees paid through the lender may or may not be included. The final outcome will change the pricing structure of mortgage loans and possibly lead to higher interest rates.

- Stricter Requirements: A firm DTI that can’t exceed 43% is one example of a new stricter requirement. However, even more important is that lenders will need to document and verify your income and assets to make sure that you meet the ability to repay rule. As a result you can expect that it will take longer time to close a loan, as well as more paperwork. Self-employed borrowers will face even greater hurdles.

- Additional safeguards: If the loan does not meet QMR standards, then in the case of a default, the lender will need to prove that the borrower was qualified based on the ability to pay rule.

Tip

Don’t rely on the cfpb’s rules to protect you. make sure you are an informed mortgage borrower. get a mortgage quote and pre-approval from a bills.com mortgage provider.

Qualified Mortgage Rule: Stop Predatory and Unfair Lending

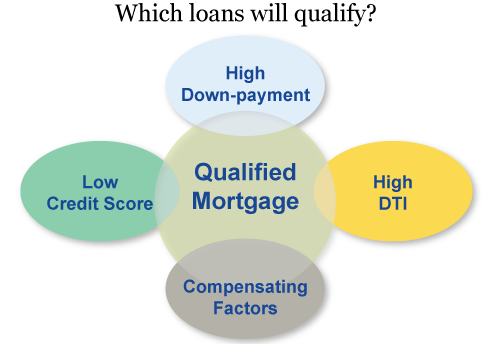

Not all borrowers qualify for a conventional loan. Some common reasons for not qualifying include: low credit scores, not having a large enough down-payment, and high debt-to-income ratios.

Before the pre-2008 housing crisis, many borrowers who wouldn't qualify today were able to qualify for mortgage loans. Lenders had relaxed their underwriting criteria, offering loans to borrowers who:

- Didn’t have sufficient income and/or documentation to qualify for a conventional loan.

- Qualified based on taking a high-risk loan, such as an interest-only payment mortgage, Adjustable Rate Mortgage, or a hybrid mortgage product.

Big problems ensued. A combination of predatory lending, inability of consumers to understand the mortgage product, and consumer irresponsibility lead to the housing crisis of 2008. In response, Congress passed the Dodd-Frank Act, to create a more regulated financial market. The Consumer Financial Protection Bureau (CFPB) acting under the Dodd-Frank Act is in the midst of revising regulations regarding the mortgage industry. Everyone agrees about the need to avoid the problems of the past. The proliferation of high-risk loans, predatory lending, and the subsequent burst of the housing balloon left the need for tighter regulation of the mortgage market.

The Qualified Mortgage Rule is one example of new mortgage lending regulation. The QMR will have a huge effect on borrowers, because it will create additional risks for lenders. It will affect the availability and price of mortgage loans.

Quick Tip #1

Learn about today’s mortgage rates at Bills.com Mortgage Rate table.

Government or Private Money in the Mortgage Market?

Since the housing crisis of 2008, most mortgage loans are guaranteed or bought by government-backed agencies, including Fannie Mae, Freddie Mac, and the FHA. The Federal Reserve Bank has also encouraged the mortgage market by purchasing mortgage-backed securities.

Will private money flow back into the mortgage market? This remains to be seen, and the final ruling on the Qualified Mortgage Rule will be crucial in determining the growth of private mortgage lending.

Predatory and unfair lending should be stopped. Lenders who take advantage of borrowers by misrepresenting risks and steering them into unaffordable products are unacceptable. Lenders should be required to advertise fairly and truthfully, and disclose information in a manner that is understandable to the consumer. This is especially true when dealing with mortgage loans that have features that change over the life of the loan, such as interest-only loans, loans with balloon payments, and adjustable-rate mortgages.

However, your job as a consumer is to ensure you receive a mortgage that best fits your financial situation. If you properly prepare yourself to shop for a mortgage loan, you will ensure getting the best rates. Take the time to understand the basics about mortgage loans and the process to qualify for a mortgage loan. Make sure that you learn about interest rates, the kinds of fees you will pay, and any risks associated with the loan amortization schedule.

Qualified Mortgage Rule: What is it?

The Dodd-Frank Act includes Title XIV, “Mortgage Reform and Anti-Predatory Act”, which covers a long list of subjects. In particular, Section 129C includes a definition of types of loans, Qualified Mortgages, which are presumed to be non-predatory in nature.

Basically, the QMR involves two-steps:

- Define what type of loan is a Qualified Mortgage.

- Provide lenders with legal protections for loans that are qualified mortgages and provide borrowers with legal remedies if the loan is not a QM.

Dodd-Frank refers to residential mortgage loans. It excludes open-ended credit (HELOCs, for instance), reverse mortgages and short-term loans. In general, a QM must meet these eight points:

- Principal doesn’t increase.

- No deferment of principal.

- No balloon payment (a payment more than double the previous payment).

- Lender documents and verifies income and financial resources.

- Loan is fully amortized.

- DTI regulations meet.

- Total points are not more than 3% of loan.

- Loan is not more than 30 years in length.

If loans do not fall into a qualified mortgage status, with an automatic “safe harbor” against borrower lawsuits against lenders, then we can expect that private money will shy away from the mortgage market. That means many borrowers will find it difficult to get a mortgage loan to refinance their current loans or to get a purchase loan to buy a home.

The QMR will most definitely affect lenders ability to give a loan. Any loan that does not fit into the QMR rule and the ability to pay rule will mean more risk for the lender. That means that the borrowers can expect an increase in mortgage rates (a premium for the additional risk) and/or a shortage of lenders willing to offer loans that don't fit into the QMR.

The picture below shows some of the key areas that may be affected by the QMR:

Qualified Mortgage and Ability to Repay Rule

Qualified Mortgages must meet the characteristics listed above, and the lender must verify that the borrower can pay back the loan. The general assumption is that conforming loans that meet the guidelines set by Fannie Mae, Freddie Mac, or the FHA meet the ability to pay rule and are Qualified Mortgages.

Getting accurate and comparable information is important for anyone shopping for a mortgage loan. Mortgage lenders follow complex lending guidelines. For example, Fannie Mae’s selling guide is more than 1,000 pages. Those rules include determining a:

- Borrower’s ability to pay (debt to income ratio, cash reserves, income stability)

- Borrower's willingness to pay (credit history and credit score)

- Fair-market property value

The underwriting rules set by the Fannie Mae, Freddie Mac and the FHA, cover very specific circumstances such as how to determine income for a self-employed borrower, or how long a borrower must wait after a bankruptcy or foreclosure before a loan will be approved. The guidelines also cover rules about gathering and verifying information.

The ability-to-pay rule is intended to ensure that the lender verified that the borrower could pay back the loan. Some of the ideas suggested for a loan to qualify as meeting an "ability-to-pay rule" and thus be a QM are:

- Down-payment: The borrower must make a down-payment of at least 20%.

- Debt-to-income ratio: The maximum debt to income ratio will be 43%.

Qualified Mortgage Rule - Be A Prepared Borrower

The QMR is an important rule for the mortgage market and. The final ruling was released by the CFPB in January 2013, but there will only go into effect in January 2014. Here are some areas it it will affect:

- How private money flows back into the mortgage market and how much government intervention will remain.

- The availability of loans for borrowers with situations that don’t exactly meet the ability to pay rule. (For example a high DTI, but compensating factors such as high net worth)

- The type of higher risk loans offered, such as adjustable-rate mortgages.

- The price of mortgages, if lenders shy away from lending to borrowers who don’t meet the strict regulations.

If you are looking to purchase a home and take or mortgage, or refinance your current mortgage, make sure that you learn about:

- Mortgage rates, through Bills.com mortgage rate table

- Qualifying for a home purchase loan or a mortgage refinance loan

Quick Tip

get a mortgage quote from a bills.com mortgage provider.

That is a great question Harry. Of course we will only know once the Qualified Mortgage Rule is finalized. (There will also be a certain transition period for compliance).

The basic rules for a conventional loan will most likely remain the same. So if you qualify for a conventional conforming loan today, you will qualify for a qualified loan in the future. In fact, the QMR is based on the lender making sure that you have the ability to pay back the loan. Conventional loans are the guideline used.

However, if your DTI is high and the lender needs to use compensating factors to qualify you, then the QMR might pose a problem.

In addition, the QMR might put upward pressure on mortgage rates. I recommend that you start shopping around and get a mortgage quote from a Bills.com mortgage provider.

.