- The mortgage refinance market is shrinking.

- As of January 2018, there are about 2.6 million households with an incentive to refinance.

- Cash-out and Adjustable Rate Mortgages are two strong refinance alternatives.

Is Mortgage Refinance a Viable Option in 2018?

Mortgage rates are on the rise. According to Freddie Mac's Weekly Primary Mortgage Market Survey, between January 3, 2018, and March 3, 2018, 30-year Fixed Rate Mortgage (FRM) rates rose by 12%. going from 3.95% to 4.43%.

Rising mortgage rates generally cool off the refinance market. However, there are still many refinance opportunities and many good reasons to refinance including lower monthly payments and taking cash out of the home.

According to the Black Knight Mortgage Monitor report for January 2018:

2.65 million potential candidates could still both benefit from and likely qualify for a refinance at today’s rates

If you were not one of the households fortunate enough to refinance in the last few years into a low-rate mortgage, when rates were at or near record lows, there are still opportunities available and reasons to refinance.

Shop for a Refinance Mortgage

While mortgage rates have increased in the beginning of 2018, they are still at low levels. Get a mortgage quote from a Bills.com mortgage provider.

Rising Mortgage Rates in 2018. Where to?

While it is true that mortgage rates are increasing, there is no guarantee that rates will continue to increase. In fact, mortgage rates have fluctuated during the last 6 years. Based on the Freddie Mac Primary Mortgage Market Survey, the 30-year FRM was as low as 3.31% on November 21, 2012, and hit 4.58% on August 22, 2013.

There are a number of mortgage rate forecasts, which are constantly being revised. As of March 2018, Fannie Mae predicts that 30-yr FRM rates will reach 4.5% and the Mortgage Banker Association (MBA) predicts rates closer to 5%.

Smaller Refinance Market in 2018, But Still Alternatives

Have you already refinanced your mortgage? Maybe, more than once? If not, then there are still mortgage refinance alternatives.

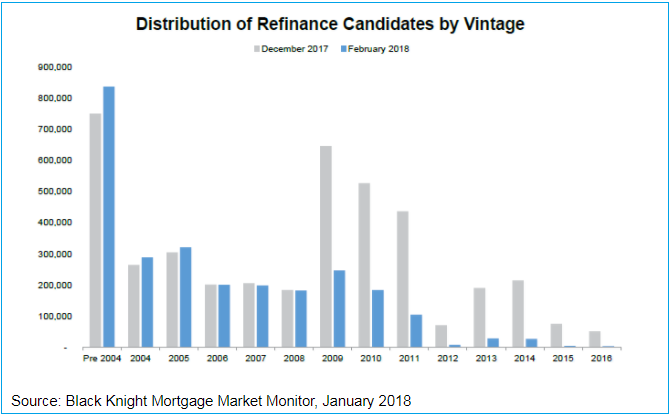

Due to the extended period of low mortgage rates, many homeowners have already refinanced high-rate mortgages into lower-rate affordable mortgages. Based on the analysis by Black Knight, a leading mortgage market analyst, very few borrowers who took out loans since 2012 have an incentive to refinance their mortgage. There are still a substantial number of borrowers with a refinance incentive post-2004, the largest group are those from the pre-2004 area,. They could stretch out payments to a new 30-year period with lower payments, or take out a short-term mortgage, 15-years or less.

Based on current trends, three popular mortgage refinance options are cash-out refinances, refinance without paying for mortgage insurance, and adjustable rate mortgages.

Alternative 1 - Cash-out Refinances: Due to the rise of home prices in most areas of the United States, homeowners now have more equity in their homes. The extra equity can be tapped into for a number of reasons, including home renovations, paying off high-interest credit card debt, and paying for college education.

Alternative 2 - Refinance without mortgage insurance: If you took out an FHA mortgage loan or a conventional mortgage with a high loan to value (LTV), then you might be able to take advantage of rising home prices and refinance into a mortgage without mortgage insurance. Depending on your current rate plus mortgage insurance premium, the new refinance mortgage might save you money.

Alternative 3: Adjusted Rate Mortgage (ARM): An adjustable rate mortgage, such as a 5/1 ARM, has a lower interest rate for the initial period. The difference between the ARM rate and the 30-year FRM as of March 2018, was about 0.75%. Although you are guaranteed savings for the initial five years, ARMs carry the risk of higher interest rate and payment adjustments during the life of the loan.

Get a Mortgage Refinance Loan Quote

When refinancing a mortgage, it is important to check your financial situation and financial goal. If you can afford higher monthly payments, then choose a 15-year FRM and lock into a lower interest rate. If you want to extend your mortgage consider a 20-year FRM instead of a 30-year FRM. If you want to take more risks or believe that you won’t hold on to your loan for a long period, then consider a 5/1 ARM. Get a mortgage quote now.