- The CFPB's July 2012 report dealt with 23,800 mortgage complaints.

- According to the report, 54% of mortgage complaints dealt with problems when you are unable to pay.

- Learn about your options and how to make a complaint.

Mortgage Complaints: Be an Informed Consumer

We have all read consumers writing mortgage complaints about the service they get when taking out a mortgage, paying off a mortgage, trying to modify their mortgage, and attempting to avoid foreclosure.

The CFPB (Consumer Financial Protection Bureau) initiated a complaint process and database, including mortgage complaints. Their process includes accepting complaints (through an online process), and following through to get the lender’s response and corrections that are taken.

In July 2012, the CFPB released data about 55,300 consumer complaints relating to mortgages (43%), credit cards (34%), and other consumer financial products. In order to help you guide yourself through the mortgage process, learn about:

- CFPB mortgage complaint survey (July 2012) -Reasons for mortgage complaints

- Read your paperwork

- Avoiding foreclosure - learn about your options.

If you feel that you are being taken advantage of then ask questions. Use the CFPB’s mortgage complaint process.

Reasons for Mortgage Complaints

The CFPB published a snapshot of their survey and included a number of real life examples, including these examples:

- A 77 year old blind Army Veteran, "who overpaid his mortgage for more than three years because he could not find the right paperwork. When the CFPB contacted the bank, it reimbursed him $30,000."

- A 38-year old lawyer, "who got the runaround for three years from his bank while he tried to modify his mortgage. After the CFPB got involved, the bank reimbursed Tom $20,000 for their errors."

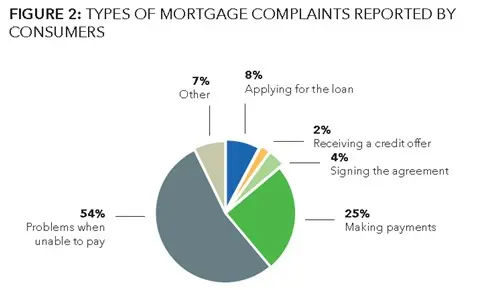

The table below shows the types of mortgage complaints, as reported by consumers, for the approximately 23,800 mortgage complaints received by the CFPB.

| Stage | % |

|---|---|

| Applying for the loan (Application, originator, mortgage broker) | 8% |

| Receiving a credit offer (Credit decision / Underwriting) | 2% |

| Signing the agreement (Settlement process and costs) | 4% |

| Making payments (Loan servicing, payments, escrow accounts) | 25% |

| Problems when you are unable to pay (Loan modification, collection, foreclosure) | 54% |

| Other | 7% |

| Total | 100% |

Mortgage Complaints: Follow your statements

The great majority of complaints deal with mortgage servicing. You loan is not always service by your mortgage originator. In effect, you do not have control over who services your loan. However, you can take steps to make sure that you avoid problems by:

- Keeping good records: Make sure that you file all your loan documents in an accessible file. That includes your loan documents, your escrow account documents (property insurance and property tax), and your bank records.

- Read your mortgage statements. Your servicer provides an annual statement, which should include important information, including contact information, payment schedule and information regarding mortgage insurance, if relevant.

- If you have a problem, then use your servicer’s on-line or customer phone assistance. Don’t hesitate to call if you have a problem setting up automatic payments, or any other regular payment problems.

- If you are having problems making payments, then immediately find out the appropriate department that deals with foreclosure avoidance. Since the National Mortgage Settlement, major banks are setting up a contact person, so that you do not go through a modification process with one department and a foreclosure process with another.

- If you are not getting good service, then contact both a customer service department within your servicer’s organization and file a mortgage complaint with the CFPB.

Mortgage Complaints: Learn About Your Options

The CFPB had created a special section in their Web site called Know before you owe that deals with the disclosure forms before taking a loan. The intention is to have a clearer form, to replace the truth in lending (TIL) form and the GFE (good faith estimate).

Taking a Loan: A mortgage loan is part of a complicated and large financial (and legal) transaction. Before you take a mortgage, learn about qualifying for a loan, mortgage rates and mortgage fees. Don’t hesitate to ask your loan officer or mortgage broker questions. It is important that you understand the benefits and risks of any type of loan that you take.

Quick tip

if you are looking for a mortgage loan (purchase or refinance) then get a mortgage quote from a bills.com mortgage provider.

Paying your Loan: Most of the mortgage complaints that the CFPB received dealt with the servicing process, especially modifications and foreclosure avoidance processes. There are special programs for underwater borrower, including the MHA (Making Home Affordable), If you are having problems that make yourself aware of your different foreclosure alternatives including:

- Refinance: If you are underwater or have bad credit, then look into the HARP loan, FHA streamline, and the VA refinance programs. The regular FHA refinance loan also has less stringent refinance requirements, although lenders may have stricter overlays.

- Loan Modifications: Many servicers will initiate a loan modification program, if they feel that you are in a hardship and can meet the monthly payments. Check out information about the HAMP guidelines for a loan modification, as well as on-line information from your servicer.

- Short sale or deed-in-lieu of foreclosure: If you are underwater and struggling to pay back your loan, then speak to your lender about a short sale. If you have mortgage insurance, then receive information from the MI (mortgage insurance) company. (You can find information on your annual statements and/or mortgage insurance companies Web sites). Many MI companies have departments that will help you find a solution to maintain your loan.

Although being aware of different programs is not necessarily going to get you better service, it will help you deal with the lender in a more constructive manner. Don’t be afraid to make a mortgage complaint with the CFPB, the Federal Reserve or the relevant customer service complaint department. If you are in need of legal assistance, then seek professional legal help.

It is unfortunate you suffer from bad advice. The good news is 6 months after one late payment you can apply for a HARP loan, as you're allowed one late payment in the last 12 months, but none within the past 6.