- A mortgage lender looks at the amount of equity you have in your home.

- The lower your LTV the less risky the loan.

- High LTV loans are available for purchase and refinance, but usually require mortgage insurance.

Getting a Mortgage Loan: Understanding Downpayment, Equity and LTV

Editor’s Note

: In order to help you become a better mortgage shopper, take the time to read a few articles about mortgage basics. This is the third article in a three part series. Make sure to read them all!

- The Basic Terms: Payment Schedules, Interest Rates and Fees

- Credit Criteria: Credit Scores, Credit History, and Income Criteria

- House Value and LTV: Down-payment and Equity

No matter what type of mortgage loan you are looking for, any lender will want to know the value of the house and how much equity you have in the property. Your lender wants to know if you can pay back the loan. It checks your creditworthiness and debt-to-income ratio to determine how high or low a risk it is to lend to you.

When you take out a mortgage, your property provides security to the lender, in case you don't pay back the loan as agreed. In exchange for getting a loan, your home (or property) is collateral. The security provides the lender additional assurance that the loan will be repaid and makes it possible for you to take out a long-term loan at lower interest rates.

Tip

The more equity you have in your property, the less the risk for your lender. Also, make sure that you have other funds available for all of your closing costs.

Mortgage Basics: Down-payment and Equity

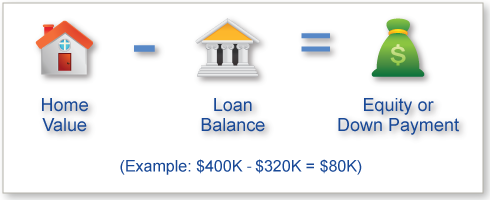

Lenders evaluate your home value differently for a purchase loan than a refinance loan. For a purchase-mortgage loan the lender looks at the size of your down-payment. If you are refinancing your current mortgage loan, then the lender evaluates how much equity you have. Your equity is the difference between the appraised value of the property and the total amount of mortgage/debts registered against the property. Lenders use the phrase LTV (loan-to-value ratio) to describe the amount of loan you are taking as a percentage of your home's value.

Mortgage Basics: Loan to Value Ratio (LTV)

Lenders use the phrase LTV to describe the amount of loan you are taking as a percentage of your home's value. Here is an example of an 80% LTV as illustrated below:

- Purchase Price and Appraised Value: $400,000

- Down Payment: $80000

- Mortgage Loan: $320,000

Now that you understand the basic mortgage terms down-payment and LTV learn about:

- Appraisals: Determining the value of the property

- Purchase Loans: Down-payment, LTV, and types of loans

- Refinance Loans: Equity, LTV, and types of loans

Appraisals: Determining the Value of Your Property

For a purchase loan, lenders use the lower value between the purchase price and the appraised value. If you are getting a real bargain, purchasing a property for less than its real market value, then expect to get a loan for 80% of the purchase price.

Here are some of the basic requirements that an appraiser must perform for a standard appraisal:

- Properly identify the property.

- Conduct a personal inspection of the exterior and interior.

- Inspect the neighborhood.

- Compare the property to other similar property sold in the area.

There are instances whereby lenders use automated valuation models (AVM), such as Freddie Mac’s HVE (Home Value Explore). These models help the lender determine the value of the property, but do not substitute for a physical go-over of the property.

Appraisals vary in price but run around $250-$450 for a single-family house, depending on local market conditions. Your lender will generally send/choose an appraiser. According to current law, even though you pay for the appraisal, it belongs to the lender. This means that if you decide to switch lenders, you will have to pay for another appraisal.

A borrower often wants to know the value of the property before taking a loan. This is especially important if you're looking to refinance. Using a tax assessment, asking a real estate agent, or looking up the value on an online Web site can be helpful, but is certainly not reliable in terms of knowing the appraised value for the purpose of taking a loan.

Purchase Mortgage Loan: Your Down-payment

Most lenders require a down payment of at least 20%. However lenders will grant a higher LTV (between 80% -95%) if you pay for mortgage insurance (MI). The MI provides additional security to the lender in the case of default. For you, the borrower, it is an additional financing cost, that you pay until your LTV reaches 78-80%.

Quick tip #1

The amount of money you can borrow is a function of your credit and ability to pay and your down payment. Check out Bills.com mortgage affordability calculator to see how big of a loan you can qualify for.

An FHA loan only requires a down payment of 3.5%, allowing you to take out a loan with a LTV of 96.5%. However, FHA loans require a hefty upfront MIP (mortgage insurance premium) and an annual MIP. The premium increased in April 2012 and there is talk of additional increases.

VA loans, for eligible veterans offer many advantages including a no down-payment (100%) financing, easy credit requirements, no mortgage insurance and lower rates and fees. You need to have a COE (Certificate of Eligibility) in order to obtain a VA loan.

Refinance mortgage: Equity

If you want to refinance, your lender will look at how much equity you have in your house. Your equity is the current market value of your house less the total amount of mortgage loans on your property.

Your equity stake would be 25% and your LTV 75% in the following example:

- House Value: $400,000

- Total Mortgage Loans: $300,000

- Equity: $100,000

In general refinance loans are similar to home purchase loans. You can receive up to 80% financing and if you need more then you will need to pay for MI. If you need to borrow more than 80%, look into FHA and VA refinance loans that allow higher LTV limits. There are loans available for borrowers whose homes are worth less than the balance of their loans, including these refinance programs:

- HARP 2 refinance loans for Fannie Mae or Freddie Mac loans

- FHA streamline for FHA loans

- VA IRRRL streamline loans for VA loans

Remember, many lenders have stricter requirements than those of the various programs. If turned down by one lender, then get shopping.

Quick tip #2

Check out your refinancing options with Bills.com refinance calculator.

Summary: LTV, Down payment, Equity and your Mortgage

Saving money for your down payment, or building up your equity in your home is a big step towards getting a mortgage. If your LTV is too high, then your lender will require Mortgage Insurance, which will add to the cost of your mortgage.

For a purchase mortgage loan the lender will look at your down payment. Make sure that you build a savings fund toward your house purchase. Ideally have at least a 20% down payment so that you won’t have to pay for MI.

Your lender will evaluate your equity position to determine if you need MI for a refinance loan. If you have a LTV under 80% you won’t need MI on a conventional loan. There are currently programs in 2012 for underwater borrowers who have negative equity positions. For example, the HARP program has unlimited LTV requirements.

Quick tip #3

When you are ready to shop for a mortgage, then get a mortgage quote from a bills.com mortgage provider.