FHFA Extends the HARP Program Again

- Over 3.4 million borrowers have refinanced using the HARP mortgage.

- As of March 2017 there are an estimated 143,000 eligible borrowers that can still benefit from a HARP refinance.

- The HARP program was extended until December 31, 2018 and the new replacement program was delayed until 2019.

HARP Mortgage - Going Going…Extended

Just when you thought that the HARP mortgage loan was over, the FHFA announced a last-minute extension. HARP loans will be available until December 31, 2018, instead of ending September 30th, 2017.

The HARP program has helped over 3.4 million homeowners with a loan-to-value (LTV) over 80% refinance into lower rates and affordable loans. The FHFA (The Federal Housing Finance Agency, the agency responsible for HARP) estimates that 143,000 homeowners are eligible for the HARP program, as of March 2017.

In order to help you take advantage of today’s low mortgage rates, learn about your HARP options. Even if you are not HARP eligible, you may now be eligible to refinance into a conventional, FHA, VA, or USDA refinance, due to an increase in your home's value.

The FHFA also announced that once HARP ends, the High LTV Streamlined Refinance program, will replace HARP, beginning in January, 2019.

Get a Mortgage Refinance Quote

Are you eligible for a HARP loan? Bills.com can help you refinance your mortgage at today's low rates. It pays to apply now.

The High LTV Streamlined Finance Program

There has been growing anticipation for the details of the program that will replace HARP, especially as the September 2017 HARP expiration date got closer. However, with the new FHFA announcement, the new program is still a long way down the road.

Who knows, maybe home prices will rise enough making a High LTV loan necessary? A hike in interest rates, still at or near historical lows rates, would also decrease the number of people who would benefit from the new High LTV Streamlined Refinance program. Fannie Mae, in their August 2017 Forecast, predicts that Interest rates will be around 4-4.1% through the end of 2018. However, we know that interest rates are hard to predict. Perhaps interest rates will rise.

The High LTV Streamlined Finance Program, similar to HARP, is designed to help homeowners with high LTVs. The lowest acceptable LTV will be 95%, based on the standard limited cash-out refinance. One advantage of the new program is that your current HARP loan will be eligible if you have had your current loan for at least 15 months.

Bills.com expects that the program will be helpful to a very limited number of borrowers. We will be monitoring what happens and will keep you informed of the details when the program becomes a real alternative and a true measure of its effect on the market conditions in place can be measured.

High Loan-to-Value Refinance Option Update

Fannie Mae announced on May 22, 2018, that

"We originally communicated that for the new loan to be eligible, the minimum LTV ratio for a one-unit, principal residence would be 95.01%. With this Lender Letter, we are updating the minimum LTV ratio to be 97.01%.

The new loan option will be available for eligible refinance applications received on or after Nov. 1, 2018November 2018.

Remember to bookmark this page for further updates.

HARP Extension: Meet the Basic Requirements

The HARP program’s eligibility requirements have several limitations. HARP loan requirements include:

- Fannie Mae or Freddie Mac owned or guaranteed the loans.

- Original loan originated before June 1, 2009.

- LTV is over 80%, but primarily aimed for borrowers that don’t have equity. There is no LTV upper limit.

- Borrowers are current on their mortgage.

- Borrower have no more than one late payment in the past 12 months, but no late payments in the six months preceding the refinance.

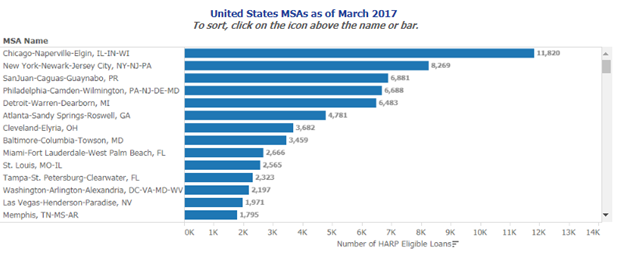

The FHFA publishes data regarding the number of eligible HARP borrowers, based on the basic eligibility requirements and additional filters. They estimate, as of March 2017, that there are over 143,000 borrowers who can benefit from a HARP refinance. This is 56% less than the number estimated in March 2016. During 2016 about 67,000 HARP loans were originated, and another 23,000 in the first two quarters of 2017.

To estimate the number of HARP-eligible borrowers who would benefit from a HARP loan, the FHFA applies the following filters to the HARP-eligible loans:

- A remaining principal balance on the first loan greater than $50,000; r

- More than 10 years remain to pay off the loan as agreed

- The current note rate is 150 basis points (1.5%) above the market rate.

HARP Extension Until 2018: Hard Hit Areas

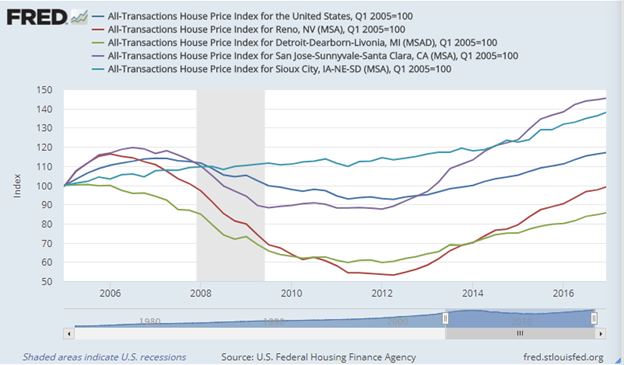

Housing prices declined across the US during the Great Recession of 2008 in almost every market. However, some areas were harder hit than others. While many areas have increased to at or above their previous, pre-recession peak, there are still areas that have not recovered.

Do you live in an area where housing prices haven't bounced back? A graph from the harp.gov website shows that the top 14 counties represent 46% of all FHFA estimated HARP eligible borrowers! if you own a home in one of these areas, you are a prime HARP candidate.

Check your housing value and see if your equity position has improved. If it has, you maybe able to qualify for a conventional loan (up to 97% LTV), or an FHA loan (up to 96.5% LTV).

The following graph shows how housing prices in 4 cities compare to the US average, based on the FHFA All-Transaction HPI.

HARP Loans: Loosening Credit Score Requirements

In general, the HARP program did not require a minimum credit score. However, as the program progressed, lenders set stricter requirements, generally at least a 620 score. (Certain manually underwritten loans that had a monthly payment 20% higher than on the original loan were exceptions),

The newly announced HARP extension helps borrowers in two ways:

- Borrowers had a chance to improve their credit score since 2009, reducing the number turned down for not meeting lender minimum score requirements.

- Lenders have eased their lending criteria.

The average credit scores for Freddie Mac HARP loans during the period Q1 2009 - Q2 2016 was 735. However, there was a marked decrease since mid-2013. Check out the following graph based on Freddie Mac Data for HARP originated loans:

Bottom line: You don't need excellent credit to qualify. Even if your credit is only fair, shopping for a HARP refinance loan could save you money.

Refinance Your Mortgage - Get a Quote Now

Take advantage of low interest rates and find a mortgage that fits you budget. Get a refinance quote now.

6 Comments

Great news for those underwater and in need of relief from their mortgage who cannot qualify for a traditional conforming refi. I hope the word gets out and Americans find out that this is indeed being extended.

Given the fact that HARP was so successful, with over 3.4 million HARP loans closed, as well as it being a program started under President Obama and extended under President Trump, I believe there will be ample coverage in the news. Consumers will also be exposed by mortgage lenders and others advertising HARP's continued availability.

Thanks for the Update. My home price plummeted in 2008 and still hasn't come back. My credit score was hit hard. I have been working to get back on the right financial path. Good to know that the HARP program will still be around. Would you recommend a 15-year or 30-year loan?

Good to hear that you are heading in the right direction. The key factors in determining 15-year vs. 30-year are affordability and the interest rate difference between the two. If there is not a huge savings benefit by taking the 15-year, then I recommend sticking with the lower mandated payment of the 30-year and paying principal aggressively when possible.

This is great news. So many people still need help to stay in their homes and don't want to have their credit take (another) hit if they default. Is there any chance that the real minimum acceptable credit score will be lower than 620?

Since HARP 2.0 in 2012, credit scores less than 620 did not necessarily exclude borrowers from qualifying for a HARP loan. The credit score barrier was stricter, however, from lenders offering HARP loans. Lenders are permitted to enforce stricter criteria than program guidelines mandate, and almost always required a 620+ score to qualify.

About 3.7% of Fannie Mae HARP loans were originated with a main borrower's FICO score under 620, looking at over one million Fannie Mae HARP loans from 2009-2016. Given the number of years the program has been in place and the time a borrower has had after the economy went south, I believe lenders will feel that those below 620 still pose an unacceptable risk and approvals for these borrowers will continue to be limited.