Can I Qualify for a Cash-Out Mortgage?

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit

- You need equity in your home to qualify for a cash-out mortgage, usually about 80% loan to value (LTV).

- Lenders generally require a good credit score.

- There are some new mortgage products with more lenient qualification requirements.

Is it Difficult to Qualify for a Cash-Out Refinance?

I now have equity in my house and want to take out some cash to pay off credit card debt. My credit score took a hit because of medical bills and a temporary loss of work. I am now self-employed and hope that I can qualify. Do you have any advice on how I can qualify for a cash-out mortgage?

Thank you for your question about qualifying for a cash-out refinance.

Qualifying for a cash-out mortgage is similar to a rate and term refinance or a purchase mortgage. Lenders will look at three underlying factors to decide if you qualify for the cash-out refinance: equity or Loan to Value ration (LTV), credit score and credit history, and your income and Debt to Income ratio (DTI).

Before shopping for a cash-out mortgage, it is a good idea to be aware of the unique factors in a cash-out refinance mortgage. Just like other mortgages, there are various loan products, each with their unique standards. On top of program requirements, lenders often have their own stricter rules, or overlays.

When considering if you can qualify for a cash-out mortgage consider these three programs:

- Conventional Cash-out Mortgage

- Non-QM Cash-Out

- FHA Cash-Out

Qualifying for a Cash-Out - Your Equity Position

When looking to qualify for a cash-out mortgage the first thing to look at is your home equity. You are probably familiar with a regular purchase or refinance loan that allows for a very high loan to value ratio (LTV). Conventional loans are topped at 95-97% LTV, and FHA loans go up to 96.5%

However, qualifying for a cash-out refinance is more difficult. You have to have a larger equity position in your home. Conventional loans are the most common type of cash-out refinance. The general rule of thumb is 80% loan to value ratio. Here is a simple example:

- Current Home Value = $300,000

- Current Mortgage Balance = $200,000

- Current Loan to Value ratio (LTV) = 67%

- Maximum LTV allowed = 80%

- You can take out an additional $40,000, bringing your total LTV to 80%. If the lender allows for an 85% LTV, then you could take out an additional $55,000 over your original loan balance.

Cash-Out Equity Calculator

Use the Cash-Out Home Equity Calculator below to figure out how the maximum amount of cash you can take out in your cash-out mortgage. (Click here for the full Cash-out Calculator).

Qualifying for a Conventional Loan Cash-Out Refinance

As noted, 80% LTV limit is the maximum amount for a single family primary residence. However, there are lower limits for higher risk conventional loans. For example, Fannie Mae has different maximum LTV levels for their standard cash-out loans based on the type of property. Here are a few examples:

- Primary Residence 1 unit: 80%

- Primary Residence 2-4 units: 75%

- Second Home 1 unit: 75%

- Investment Property 1 unit: 75%

- Investment Property 2-4 units: 70%.

Fannie Mae does not distinguish between a Fixed Rate Mortgage (FRM) and an Adjustable Rate Mortgage (ARM).

Note: Fannie Mae also has a limited cash-out refinance, which is a regular rate and term refinance that allows the borrower to take out money to cover closing costs.

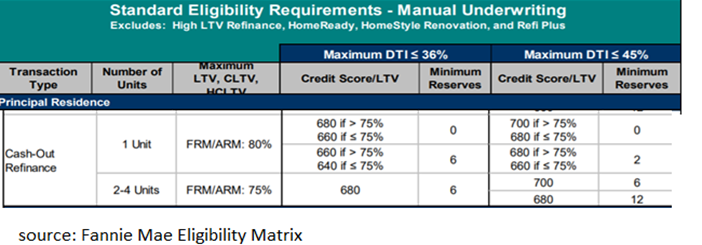

To qualify for a conventional cash-out mortgage you will need a credit score of at least 620, which is the minimum program requirement. However, many lenders have stricter standards. Instead of using the automated "Desktop Underwriter" system, a lender can approve a cash-out using a manual underwriting system. In that case, to qualify for a loan with a 75% LTV, you would need to have a credit score over 680 and a debt to income (DTI) ratio 36% or less. Check out the following chart for more information.

Non-Qualified Mortgages

Another option is a non-qualified mortgage, which is basically a private mortgage that does not meet FHA or Conventional loan standards. These loans are still going to look at your credit score and DTI. However, the lender will be less strict in terms of documentation used to qualify your loan. This can be especially helpful for self-employed borrowers. (Don’t expect to get a mortgage without any documentation of your income and assets).

Non-QM loans are usually capped at 80-85%. Lenders will require higher FICO scores as you increase your LTV. However, there are a number of different programs.

FHA Cash-Out Refinance

FHA loans are popular because they have lower credit score requirements. In general, the FHA loan allows for a credit score as low as 500 if your LTV is under 90%. If your LTV is over 90% (up to 96.5%) then you need a minimum credit score of 580.

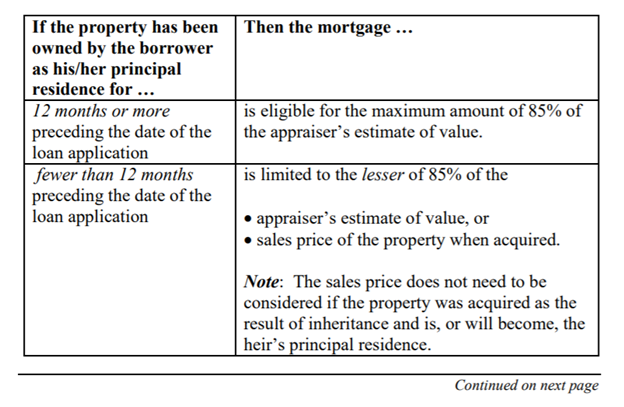

Since FHA cash-out transactions are limited to 85%, the minimum required credit score is 500; however, most lenders have stricter requirements. FHA loans require a debt to income ratio of 31% for home-related expenses, and 43% for total debt to income ratio.

One important thing to keep in mind is that FHA loans require mortgage insurance, both upfront and monthly payments.

Here are a few more points that are important to consider if you are trying to qualify for an FHA cash-out refinance: (source: https://www.hud.gov/sites/documents/4155-1_3_SECB.PDF, Change Date March 24, 2011)

- "4155.1 3.B.2.a Eligibility for Cash Out Refinances Cash out refinance transactions are only permitted on owner-occupied principal residences.

- Properties owned free and clear may be refinanced as cash out transactions.

- 4155.1 3.B.2.f Cash Out Refinancing for Debt Consolidation Cash-out refinancing for debt consolidation represents considerable risk, especially if the borrowers have not had a corresponding increase in income. Careful evaluation of this type of transaction is required

Get a Cash-Out Refinance Quote

Do you need more cash? Check to see if you qualify for a cash-out mortgage. Get a mortgage quote now.

Tap into your home’s equity for financial flexibility

How much do you want to borrow?

Checking your options won’t affect your credit