Too Much Debt? Learn to Deal with Debt

Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 5 min read

Debt, more debt, and too much debt. Just when does debt become too much debt? Or more importantly, how can you avoid getting to deep in debt.

While some people like to say that no debt is the optimal situation, that would preclude most of us from buying a home, getting a college education, and sometimes purchasing a big ticket item on installments. In fact, sometimes debt can even help us in a pinch, when our emergency savings just don't cover our extraordinary expenses.

Too Much Debt - Join the Crowd?

Household debt reached a peak before the 2008 Great Recession, during which time both household debt and non-household debt decreased. However, that trend has been reversed, and according to the New York Federal Reserve's 2016 4th Quarter Report on Household Debt and Credit.

Household Debt Edges Up as Auto, Credit Card, and Student Debt. The CMD’s latest Quarterly Report on Household Debt and Credit reveals that total household debt increased by 1.8% in the fourth quarter of 2016, rising $226 billion to reach $12.58 trillion, only 99 billion shy of its 2008 third quarter peak. Balances increased across all debt products, with a 1.6% increase in mortgage balances, a 1.9% increase in auto loan balances, a 4.3% increase in credit card balances, and a 2.4% increase in student loan balances this quarter.

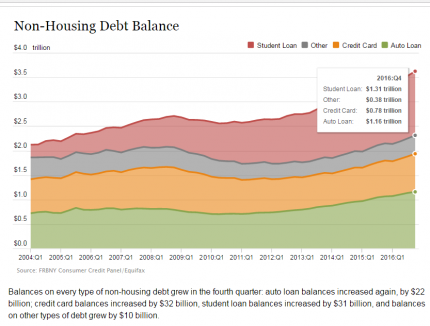

Some of the biggest increases has been student loan debt and more recently auto loans. Check out the chart to see the trends of US non-household debt.

Signs of Too Much Debt

While, there is no absolute number to say if you have too much debt, here are some useful signs to check your financial situation and determine your debt situation:

- You can't afford the monthly payments

- The new debt doesn't help you build wealth

- Looking for short-term bad credit loans or payday loans

Too Much Debt: Behind in Payments

One sure sign that you have too much debt is that you can't afford the monthly payments. Falling behind in payments will not only hurt your credit, but it will also place in you in jeopardy of facing collection calls, and even worse lawsuits, public judgments and wage garnishments.

One of the first signs is that you are making minimum payments on your credit cards debt and then maxing out your credit utilization. Since so many people don't have sufficient emergency savings funds, any big bill (medical, auto repair, home repair) means that you are scrambling for help. Oftentimes the only solution is a credit card bill. This is especially common for people suffering hardships.

Get a Free Debt Consultation

If you are struggling with too much debt, then get a no-cost, no obligation analysis of your debt options from a pre-screened debt relief provider.

Too Much Debt: Not Building Your Wealth

One common way to distinguish between debt, is good debt vs bad debt. Good debt is often referred to as debt that can help you build your wealth. The two most common examples are mortgages and student loans.

Everyone needs a home. Depending on your situation, buying a home might be advantageous over renting. However, in order to buy a home, you will almost certainly need a mortgage. (Even coming up with a down payment can be a problem). However, most mortgages require that you have good to excellent credit and sufficient income to make your monthly payments. In some cases, your debt to income ratio (DTI) can be as high as 43%. However, even if you qualify for a loan, make sure that you do not overextend yourself. A comfortable DTI would be about 25% for your household costs and 36% for your overall DTI. When you try to qualify for a mortgage, then make sure that you get an affordable one. If you have taken one too much mortgage debt, or have an adverse financial situation, then deal with your mortgage problem quickly. There are a number of mortgage foreclosure alternatives.

Student loans have mushroomed since 2008, from $0.64 billion in Q4 2008 to $1.31 trillion in Q4 2016. According to the New York Federal Reserve Feb 2017 Household Credit Report:

11.2% of aggregate student loan debt was 90+ days delinquent or in default in 2016Q4

There are many reasons that there is too much student loan debt, including a poor economy, bad job market, and high cost of education; however, it is important to carefully check the costs of the education versus the future benefits. Much of the bad debt is from expensive private schools that offered expensive degrees that did not have a matching job market. If you have found yourself in a situation with too much student debt, then distinguish between managing your federal student debt vs private student debt.

Too Much Debt: Looking for Bad Credit Loans

One way to be sure that you have too much debt is that you are contemplating bad credit loans, or payday loans. Although, in rare cases these can be a short-term solution that helps fill a gap until you can realize an asset or get back on your feet, these types of loans are most commonly referred to as debt-traps.

The Consumer Finance Protection Bureau (CFPB) proposed new rules to help protect consumers against payday loans. They claim that:

When cash is tight, some people turn to payday and similar loans to make ends meet. Though these loans offer quick access to money, they often carry an average annual interest rate of over 300 percent, in addition to other fees. For some people these loans become debt traps.

If you can't afford to pay it back, then avoid taking it. A short-term solution that only puts you into more debt, is not a good way to deal with debt.

Deal with Too Much Debt

The good news, is that there are various ways to deal with debt. The optimal solution will depend on your income, savings, and available assets.

You can manage your debt by an easy do it yourself payment schedule and pay down your debt faster. Or, you could consider a personal debt consolidation loan, and pay off your debt with a lower interest and quicker payment schedule. However, if you are struggling with your debt, and don't have good credit or adequate resources, then consider a debt settlement program, or even bankruptcy.

Too Much Debt? Find a Personalized Debt Relief Solution

If you feel that you have too much debt and are looking for a way to deal with your debt, then check out Bills.com new tool, the Debt Navigator.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836

Dealing with debt

Mortgages, credit cards, student loans, personal loans, and auto loans are common types of debts. According to the NY Federal Reserve total household debt as of Q1 2024 was $17.69 trillion. Housing debt totaled $12.82 trillion and non-housing debt was $4.88 trillion.

A significant percentage of people in the US are struggling with monthly payments and about 26% of households in the United States have debt in collections. According to data gathered by Urban.org from a sample of credit reports, the median debt in collections is $1,739. Credit card debt is prevalent and 3% have delinquent or derogatory card debt. The median debt in collections is $422.

Collection and delinquency rates vary by state. For example, in Illinois, 16% have student loan debt. Of those holding student loan debt, 7% are in default. Auto/retail loan delinquency rate is 5%.

To maintain an excellent credit score it is vital to make timely payments. However, there are many circumstances that lead to late payments or debt in collections. The good news is that there are a lot of ways to deal with debt including debt consolidation and debt relief solutions.