Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 6 min read

- Your credit will affect the types of bill consolidation choices available.

- Even if your credit is poor you can find a bill consolidation solution.

- Once you choose a program expect your credit to change.

- Start your FREE debt assessment

Table of Contents

Is there a connection between bill consolidation and credit?

I have serious debt and need a solution for consolidating my bills. Should I worry about my credit score?

Thank you for your question about bill consolidation and credit scores. First of all, it is a good sign that you are looking for a solution to your debt problems. The good news is that no matter how serious the problem, there are bill consolidation solutions.

You are correct to be concerned about the relationship between debt consolidation and credit scores. Credit scores affect the type of bill consolidation solution you can find, and the type of solution will affect your credit score.

Before looking for a bill consolidation solution look over your credit report. Make sure that the information is accurate.

If you find any negative tradelines that are inaccurate, then make sure to file a dispute with the Credit Reporting Agency.

There are personal loan options for people with excellent credit, as well as those with fair, or even poor credit. If a loan is not the best solution, then look for other debt relief options.

How Does a Bill Consolidation Program Affect Your Credit

The other side of the coin is that your credit will be affected by any debt consolidation program. The good news is that if you work on getting rid of your debt and take on good financial habits, then your credit score will increase. One pitfall to avoid is running up new credit card debt, which will hurt your credit.

Here are some general guidelines on how the various bill consolidation programs affect your credit:

Debt Consolidation Loans:

A personal loan or a cash-out refinance, or home equity mortgage have the advantage of paying off some debts including medical debt and credit cards. Although your credit score may be minimally affected by taking on new debt, a personal loan reduces your utilization rate and increases the types of loans. The bill consolidation loan should make it easier to make all of your payments on time, which will help improve your credit score.

Credit Counseling and Debt Management Program

Although most credit counseling programs do not impact your FICO score, being enrolled in a credit counseling and debt management plan does show up on your credit report. Once again, timely payments will help you improve your credit.

: In general, households entering a debt settlement program are in financial hardship. Many already have taken a hit on their credit scores due to late payments. Once you begin a debt settlement program, your credit score will continue to drop because the program has you make one monthly payment into a designated account instead of paying your creditors. The good news is that you can rebuild your credit within a couple of years.

Bankruptcy hurts your credit score immediately. The bankruptcy is registered on your credit report and stays there, from the filing date, seven years for a Chapter 13 (partial repayment plan) and ten years for a Chapter 7 bankruptcy. Once you adopt good financial habits, your credit will improve and it even possible, under certain circumstances, to obtain a mortgage after two years.

Match Your Credit to a Bill Consolidation Program

Debt is stressful. You mentioned in your question that you have serious debt. Fortunately, you now know that there are debt consolidation programs for all types of credit.

In order to help you find the solution that best fits your credit and personal financial solution, Bills.com created the Debt Navigator, which only uses a soft pull on your credit and does not negatively affect your credit score. With only a few personal questions the Debt Navigator searches for the solutions that best fit your financial abilities and goals.

Your Credit Score When Seeking a Bill Consolidation Solution

There are various bill consolidation solutions including a personal debt consolidation loan, cash-out refinance or home equity mortgage, debt management program, debt settlement, and bankruptcy.

In general, you can measure the seriousness of your debt situation by the amount of money you owe and the level of financial stress or hardship that you are suffering. Your credit score is a mirror of your financial situation, although there may be a lag between how you feel and your current credit score.

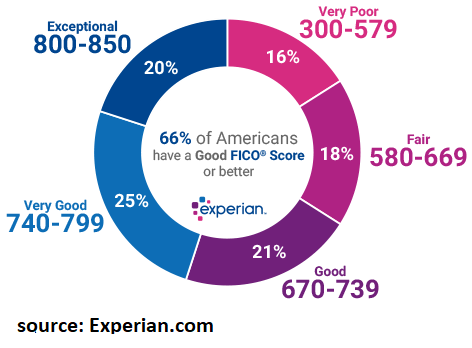

Credit scores are negatively affected by late payments, high utilization rates, and too much debt. If you are in a hardship, then most likely you are not making payments on time, and your credit score is dropping or already tanked. If, on the other hand, you have a lot of debt, but you can make your payments on time, then your credit score may still be good to excellent. The figure below shows the types of bill consolidation solutions that are available based on your level of hardship, which is generally related to your credit score, i.e., a higher level of hardship translates into a lower credit score.

Tips for a Debt Consolidation Solution and Your Credit Score

Here are a few tips for seeking a bill consolidation solution based on your credit score and credit history:

- Good to Excellent Credit: Check out a Bills Personal Debt Consolidation loan for best rates. However, assuming that you can afford the monthly payments, you can get a personal loan even if your credit score is near prime (mid 600 - 700 FICO score).

- Good - Excellent Credit: If you have built up equity in your home and are looking for a long-term loan with lower monthly payments and a low-interest rate, then consider a cash-out mortgage or home equity mortgage to consolidate your debt. Take into consideration that you are transferring unsecured debt to secured debt, and you might be increasing the amount of time to get out of debt.

- Fair-Good Credit: If your credit is good, then you might qualify for a personal loan, but the interest rates may be high. It is a good idea to compare a personal loan to a debt management plan. Unless you are on the rebound, If your credit is fair, then you are probably struggling to make payments. A debt management plan may help, but the monthly payment may not be affordable.

- Poor - Fair Credit: Most likely you are struggling. A low credit score is usually a sign of financial distress. If you are having trouble making payments, then consider a debt settlement program. Depending on your overall financial situation you might want to consider bankruptcy. While there are bad credit debt consolidation loans, those usually come at a very high price. You should be especially careful of short-term (payday) solutions. Those are quite often a debt trap.

I hope this information helps you Find. Learn & Save.

Best,

Bill

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836