Get rid of your debt faster with debt relief

Choose your debt amount

Or speak to a debt consultant 844-731-0836

- 6 min read

- Consolidate debt to improve your finances.

- Understand your current financial situation and define your goals.

- Match your goals with the appropriate debt consolidation tactic.

- Start your FREE debt assessment

Tips to Consolidate Debt and Credit

There is no one-size-fits-all approach to consolidate debt. With so much debt and different types of debt, it can be very confusing to find the debt consolidation tactic that is the right match for your financial situation.

The New York Federal Reserve reported in February 2020 that and household debt is reaching new heights:

"Household Debt Tops $14 Trillion as Mortgage Originations Reach Highest Volume Since 2005

Did you know that more than 57% of the US household have credit card debt? Total household credit card debt is about $880 billion, and the average borrower balance (for those with credit card debt) is $5,600. However, credit card debt isn’t the only type of debt.

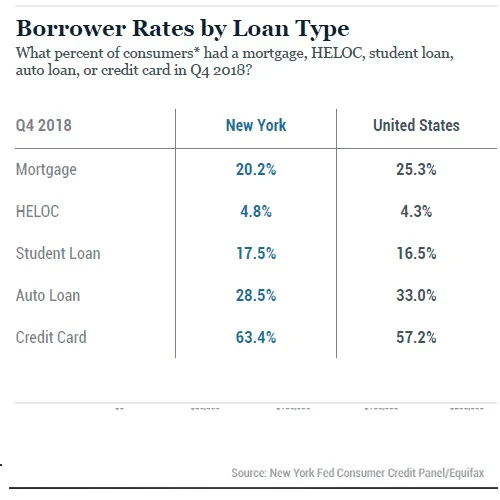

The charts below, taken from the NY Federal Reserve’s Regional Household Credit Snapshot shows the percent of consumers that have five different types of loans, as well as the average balance for those who do have loans. Remember, this does not include other bills and debt, such as medical debt.

There are some critical steps, however, for you to find the best tactic to pay off your debt.

Think of your debt as an overall part of your financial picture. Is your debt helping you increase your financial situation? For example, instead of renting, did you buy a home? Your home mortgage loan is a great way to build equity and live in a house of your own. However, if you are building up a lot of personal debt, including credit card debt, then most likely you are either in financial hardship or mismanaging your finances. Instead of building equity, you are paying lots of interest to service your debt.

Three preliminary steps to consolidate your debt:

Before you start to consolidate your debt, take these three steps:

- Check Your Debts: Make a list of all your debts, interest rates, monthly payments, and payoff dates. You can find a large part of that information on your credit report. For a free copy, visit annualcreditreport.com.

- List Your Assets: Make a thorough list of your assets. Include your savings accounts, investments, retirement funds, and any property you own. Do you have adequate savings?

- Fine-tune your budget: Keep a budget and check to see if you can cut costs and increase your income.

Consolidate Your Debt - Get a Free Consultation

We have screened debt relief providers who can help you consolidate debt by getting a debt consolidation quote.

Define Your Goals

Your next step is to define the goals you want to achieve when you consolidate your debt. You need a clear understanding of what you wish to achieve and why. If you can't explain clearly how consolidation will benefit you, you won't be able to make the right choice.

Here are some common financial goals:

- Improve Your Cash Flow: Reduce the size of your monthly payments. The money you free up can be used in a variety of ways, so maximize your chances for success. Pay your current debt more efficiently and avoid taking on new debt.

- Get Out of Debt as Fast as Possible: Becoming debt-free allows you to focus on building wealth, establishing a rainy-day fund, buying a home, or some other major purchase

- Protect Your Credit: Do you know what your credit score is today? Some ways of paying off debt can harm your credit. You need to know your current credit score so you can weigh if it is worth harming your credit, to get out of debt faster.

- Get Out of Debt at the Lowest Total Cost: Reducing your overall costs puts more money in your pocket to use for achieving other financial goals. This will require a higher monthly payment, so be sure you can afford it.

- Reduce Your Debt Stress: Stress can come from fear of missing a monthly payment, repeated collection calls, or by the uncertainty of having no defined plan in place. Achieving greater peace of mind is a very reasonable goal.

Matching Financial Goals with the Right Debt Consolidation Solution

There are different ways to consolidate your debt. The most common one is a debt consolidation loan. However, that solution is only going to work if you have strong enough credit to qualify for low-interest rates.

Be realistic about your financial situation. Over-reaching won't help you achieve any goals that you set. If you are struggling with minimum payments, then protecting your credit is not realistic. If you have bad credit, then your debt consolidation options are limited.

Here are examples of four ways to consolidate your debt and how they mesh with different financial goals.

Do-It-Yourself / Optimize Payments: If you have extra money coming in each month, good savings, and decent interest rates, then you can add extra money each month to your monthly payments. While this tactic doesn't consolidate your debt or bills, it is an effective way of paying off your debt in a fast and orderly manner. Use either the avalanche method (pay off the highest interest rates first) or the snowball method (pay off the lowest balances first). With this method, you can get out of debt quicker, protect and build your credit, and reduce your overall financial costs.

Cash-Out Mortgage or Home Equity Loan (HEL): If you have extra equity in your home and you want to reduce your monthly payments, then you can consolidate your debt by taking a cash-out refinance, or a Home Equity Loan. Your best choice will depend on whether the new interest rate will save sufficient money to warrant doing a full cash-out mortgage refinance. If not, you can consolidate your debt by taking out a HEL. Using home equity to consolidate debt can protect your credit, improve your cash flow, and reduce your debt stress. However, since the payback period on home loans will lengthen the time of your loan, you will not get out of debt so quickly, and it won't be at the lowest cost.

Debt Consolidation Loan: If you have good to excellent credit, then a debt consolidation loan is an excellent consolidation tactic. A debt consolidation loan can get you out of debt faster, protect and build your credit score and profile, and lower your financial costs. If you take out a loan, you make a firm commitment to a fixed monthly payment, so make sure that your payment is affordable.

Credit Counseling and Debt Management Plan (DMP): If you can make minimum payments and commit to a fixed monthly payment, then a DMP program can help by reducing your interest rates on your credit cards. Instead of making payment directly to your creditor, the DMP company will collect your money and pay off the creditors at a negotiated rate, allowing you to simplify your monthly payment and reduce your debt stress. It is a middle of the road approach, helping you to get out of debt quicker, reduce your financial costs, and cause slight harm to your credit.

Debt Settlement Program: A debt settlement company negotiates your debt with your creditors. You stop making payments directly to your creditor. The missed payments will lower your score, but the damage will be less severe if you already have a low credit score. This debt consolidation program is for people with financial hardship. If eligible, it will free up cash and help you get out of debt faster at a low rate. However, this will be at the expense of a damaged credit, which is generally not an issue for people in financial hardship. Also, your creditors may pursue legal actions, including collection calls and lawsuits.

Need Help to Find the Best Way to Consolidate Debt?

If you are still not sure which debt consolidation tactic is best for your situation, then check out Bills.com's Debt Payoff Calculator. This is a free service.

Get rid of your debt faster with debt relief

Take the first step towards a debt-free life with personalized debt reduction strategies.

Choose your debt amount

Or speak to a debt consultant 844-731-0836

Did you know?

If you are struggling with debt, you are not alone. According to the NY Federal Reserve total household debt as of Quarter Q1 2024 was $17.69 trillion. Student loan debt was $1.60 trillion and credit card debt was $1.12 trillion.

A significant percentage of people in the US are struggling with monthly payments and about 26% of households in the United States have debt in collections. According to data gathered by Urban.org from a sample of credit reports, the median debt in collections is $1,739. Credit card debt is prevalent and 3% have delinquent or derogatory card debt. The median debt in collections is $422.

Collection and delinquency rates vary by state. For example, in Rhode Island, 18% have student loan debt. Of those holding student loan debt, 7% are in default. Auto/retail loan delinquency rate is 3%.

Avoiding collections isn’t always possible. A sudden loss of employment, death in the family, or sickness can lead to financial hardship. Fortunately, there are many ways to deal with debt including an aggressive payment plan, debt consolidation loan, or a negotiated settlement.

10 Comments

Consolidating debt can be done in different ways, each with different effects on your credit. In the debt relief industry, debt consolidation can mean a loan that consolidates your debt, credit counseling, or debt settlement. To help you choose what option is best for you, use the free Bills.com Debt Coach tool.

Here are some factors I would consider: • How long does the 0% interest rate remain in effect? • Do you think you can pay off the entire $25,000 before the 0% rate expires? • What is the default interest rate, if you miss a payment and the 0% interest rate goes away? • What is your current mortgage interest rate? • What interest rate are you being offered for a new mortgage? • Are you seeking to consolidate debt other than the $25,000 debt you mentioned?

These are not all the questions I would consider, but it gives you a few items to chew over. I hope that this helps you in your quest to consolidate debt.