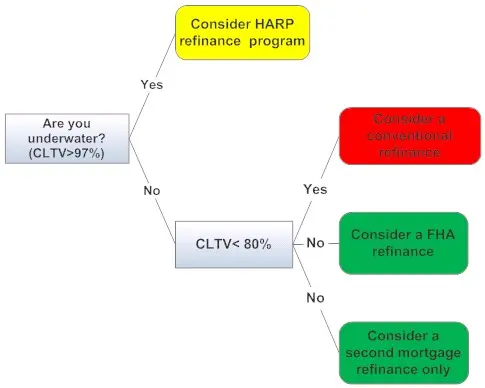

- Your options available will depend on your LTV.

- Check your personal liability on both loans.

- If you are underwater, check the HARP refinance program.

Can I refinance my first and second mortgages that are with US Bank?

We owe $97000 on our first mortgage and $57000 on an equity loan. Both are with US Bank. The first is at 6.25% and the second is at 9.49%. We bought our home in 2004 and have always been current with payments. Are we eligible for new program & and can we refinance both loans?

Thank you for you question about refinancing your first mortgage and refinancing your second mortgage. Given today's historically low interest rates, you can potentially reduce your overall interest costs, through a refinance.

Even though both your first mortgage and your second mortgage were originated and/or serviced by US Bank, it does not mean that they can be refinanced together. Most mortgage loans are sold in the secondary market, and not held by the originating lender. That means that different investors hold the mortgage guaranteeing your mortgage payments.

Basically, you have three options in mortgage refinancing involving a first mortgage refinance and a second mortgage refinance. They are:

- Consolidate the loans.

- Refinance the second mortgage only.

- Refinance the first mortgage by subordinating the second mortgage.

Your choices will be determined by your creditworthiness (income, assets, credit score, and credit history) and the value of the property. Being current on your mortgage payments is an important criterion for a successful refinance, including a HARP mortgage refinance.

In order to decide which is the best type of mortgage refinance for your first mortgage and second mortgage, consider the following factors:

- LTV (Loan-to-Value) ratio and CLTV (Combined Loan-to-Value) ratio

- Personal liability on loans. (Non-recourse or recourse)

- Subordination of second mortgage.

LTV/CLTV Ratio

The major factors in determining what type of mortgage refinancing you should consider, , beyond your personal eligibility, are your LTV (loan-to-value) and CLTV (combined loan-to-value) ratios. The LTV ratio is the balance of your first mortgage loan divided by the current, fair-market value of your home, expressed in percentage. The CLTV ratio is the balance of your first mortgage and second mortgage loans divided by the value of your house, expressed in percentage.

Your choices are shown in the chart below, based on your LTV and CLTV ratios.

Bills.com offers great information about all of the different possibilities, as follows:

- CLTV under 80%: Look into combining both loans into a conventional refinance loan.

- CLTV over 80% up to 97%: Look into combining both loans into a FHA refinance loan or only refinance your second mortgage loan.

- Underwater: Look into financing your first mortgage only into a HARP refinance loan.

Personal Liability on Loan

Mortgage refinancing has many benefits, include saving you money, or making your payments more manageable. Given your high interest rates on your current mortgages, it is well worth while looking into refinancing your mortgage loan.

However, in certain circumstances, you may be moving a loan that was a non-recourse loan into a recourse loan. In some states, like California, purchase loans for a primary residence are non-recourse loans. That means that if you default on the loan, your income and assets (beyond the house that has been mortgaged) are not at risk. Your home equity loan, unless used as purchase money, would not be considered as a non-recourse loan.

If you are underwater and/or having trouble making your payments due to financial problems, then check your state laws regarding your personal liability. Please read the information that Bills.com has about anti-deficiency and non-recourse laws.

Subordination of Second Mortgage

Whenever you have two mortgages, one has a senior position and the other a junior position. That means, if you default and the property is sold, then the proceeds first go to the senior mortgage holder. Only if funds are left over, will the junior mortgage holder be paid back.

When you refinance, you are paying back your current loan, and taking out a new loan. The first mortgage holder will want to protect its interests and not relinquish its senior position. Therefore, it will require the second mortgage holder to subordinate its position, or, in other words, allow the new loan to be in a senior position, despite the fact that it is a newer loan.

In general, getting second mortgage lenders to agree to subordination can be difficult, time consuming, and costly. If you can't subordinate, then your best option is to try to refinance your high-interest second mortgage loan.

The HARP Refinance Program

Since you ask if you are eligible for the new program, I take that to mean the HARP mortgage program. HARP has been designed to help underwater borrowers refinance their first mortgage. Under the HARP mortgage program, in order to successfully complete the refinance of your first mortgage, your second mortgage lender will have to agree to subordinate its mortgage. Since the new HARP regulations where announced in October 2011, there has been high expectations that second mortgage lenders will be more willing to subordinate than has been the case. Check with Bills.com for more information about a HARP mortgage.