- The mortgage underwriting system is detailed and complex

- Learn what it takes to qualify.

- Be prepared to provide accurate and verifiable information.

How does the mortgage underwriting and mortgage approval process work?

What does it mean if your loan has gone through local underwriting and then forwarded to National underwriting? How long is the process?

Thank you for your excellent question about mortgage processing and mortgage underwriting.

Here are four important points you should know about the mortgage approval and mortgage underwriting process before getting a pre-approval and applying for a loan:

- Underwriters may use a manual system or automated underwriting system.

- Lenders’ requirements and secondary market requirements are not always identical.

- Mortgage requirements and mortgage guidelines are complicated and vary from time to time.

- Learn about delays and backlogs in the mortgage underwriting process.

Ultimately, the underwriter decides whether to approve a loan.

Underwriting Systems

Two key elements in mortgage underwriting are:

- Major secondary market players

- The type of mortgage underwriting system used: Automated vs. manual systems

Major Secondary Market Players

Fannie Mae and Freddie Mac are the two largest loan buyers. The third major player, the Federal Housing Administration (FHA), insures mortgage loans, thus greatly reducing lenders’ risks. Fannie, Freddie, and the FHA have their own set of mortgage guidelines and mortgage underwriting requirements. A lender must be extremely careful to abide by all the secondary market underwriting rules and regulations. Failure to comply with these requirements places the lender at risk of having to buy back the loan.

Automated vs. Manual Systems

Loan originators use one of two systems to underwrite loans — automated and manual. If the underwriting system is manual, then the underwriter needs to be extra cautious to avoid mistakes and ensure it follows all underwriting rules.

Automated systems allow lenders to transfer information in a comprehensive and orderly fashion, with built in checks and balances. If there is an initial approval status, then the file will be sent to the lender’s underwriter who will review the file before final approval. If not, then it will be sent back for manual review, examining if any compensating factors exist that allow the loan to be approved.

If the underwriting system is manual, then the underwriter will be more cautious to avoid mistakes. Any information placed in the system must be verified carefully, otherwise the lender might be at risk. If the loan defaults and the lender was not careful to follow all the rules set down by the secondary market participant (Fannie, Freddie, or the FHA, for example), then it must pay the insurer or buy back the loan from the secondary market buyer.

The major automated systems are:

- Fannie Mae’s: Desktop Underwriter (DU)

- Freddie Mac’s: Loan Prospector (LP)

- HUD: Manual that outlines the underwriting process and underwriting requirements.

| Conforming Mortgage Facts | |

|---|---|

| General limit One unit | $417,000 |

| "Super conforming" limit | $625,500 |

| Maximum loan-to-value | Fixed: 97%, ARM: 90%, Interest-only: 70% |

| Maximum loan-to-value Cash-out refinance | Fixed: 85%, ARM: 75% |

| Credit score with DTI < 36% | Fixed: 680 with LTV >75%, Fixed: 620 with LTV <75%, ARM: 680 with LTV >75%, 640 with LTV <75% |

| Credit score with DTI < 45% | 700 with LTV >75%, 640 with LTV <75% |

| Conforming loans market share, 2011 | ~60% |

Source: 2012 Fannie Mae; Bills.com

According to Freddie Mac, an automated underwriting system improves the mortgage process by lowering costs, expanding markets, and making lending decisions faster and fairer.

Secondary Market Requirements

Loan originators, including well-known national banks, sell most home loans to the secondary market. Other loans are insured by third parties. Fewer, generally non-conforming loans are held on by the lending institution.

Each lending institution has its own lending criteria, which can be stricter than those of the the insurer or secondary market. Therefore, it is possible that you may be turned down by one lending institution and approved by another. However, all institutions, that wish to transfer the risk of their loans to a third party, must comply with the secondary’s underwriter guidelines.

Mortgage Underwriting Guidelines — Mortgage Requirements

Before you shop for a mortgage, learn about the basic mortgage requirements that will make you eligible for a loan. These requirements will vary over time. As we all know, after the housing crash of 2008, the mortgage underwriting practices became much tighter and it became more difficult to gain approval for a loan. The mortgage requirements not only became stricter, but so did the verification process.

The underwriting process evaluates all aspects of the loan application, including:

- Income

- Assets

- Credit rating

- Debts

- House value

Just as important as it is to evaluate the borrower and their property, the underwriter is required to verify all documentation, according to strict standards.

The HUD has a 413-page, very detailed manual, entitled "HUD 4155.1 Mortgage Credit Analysis for Mortgage Insurance." It outlines credit policy and procedure for collecting, analyzing, verifying and approving all aspects of a loan application. Among those most relevant to your personal situation, the manual stipulates in section 4155.1 1.A.1.b.:

The underwriter evaluates the four C’s of credit to determine a borrowers creditworthiness.

The four C’s of credit are a borrower’s:

1. Credit history

2. Capacity to repay

3. Cash assets available to close the mortgage

4. Collateral.

To get an idea of just how complicated the mortgage underwriting process can be, see Fannie Mae’s Frequently Asked Underwriting Questions, which deals with types of property, discretionary withdrawals from 401(k), or paying off revolving debts to qualify for a loan.

Quick tip

contact one of bills.com’s pre-screened refinance partners for a free, no-hassle mortgage quote.

Pre-approval and Approval — Mortgage Processing

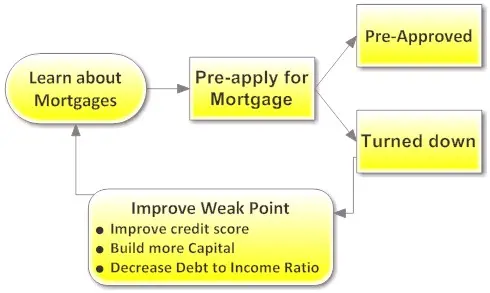

Your first steps toward getting a mortgage loan are to learn about the mortgage requirements.

Bills.com offers many great resources about getting a mortgage and various mortgage requirements, including specific information as follows:

- How to qualify for a mortgage refinance.

- FHA loan see, the page about FHA loan requirements.

- Applying for a mortgage with one spouse who has bad credit.

- How to qualify for a mortgage.

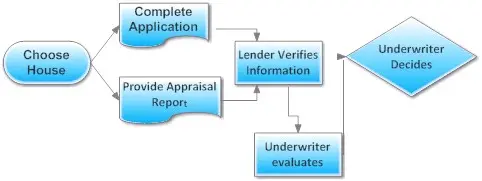

Once you are pre-approved and chose a property, you will fill out a complete application form and attach all relevant documents about yourself and the property. You must provide an appraisal report, according to the standards laid down by the lender and the underwriter.

the underwriters decision will be one of the following outcomes:

- approval: no conditions added.

- approved with conditions: either additional documentation must be sent to the underwriter before making the final credit decision, or additional condition must be met, under the lender’s supervision, before funding.

- suspended: the underwriter cannot make a decision due to incomplete information, for example, incomplete tax returns.

- denial: the application does not meet minimal standards. a denial letter with the reason for denial are sent to the borrowers.

once approved, you can move on to close the loan.

backlogs

although automated underwriting programs have allowed the market to streamline their operations, the mortgage underwriting process is still a long and complicated process. the mortgage eligibility requirements are complicated. here are some reasons that your application may take more time:

- understaffed departments: there have been big layoffs in the mortgage industry, including processors and underwriters.

- more documentation required: underwriters want more information about an oddity it finds in the application.

- missing or incorrect information: requires the borrower and the lender/broker to provide more paperwork and explanations.

- compensating factors: even though the systems look for standardization, each person is unique. the mortgage underwriting process & allows for compensating factors, permitting a strength in one area to make up for a weakness in another area. freddie mac gives an example of a person with few assets but high income. another example is a person with little cash reserves, but an inherited property, that can be used as collateral.

- changes in programs: one example is that of the harp program,aimed at refinancing underwater mortgages. broad policy changes were announced in october 2011, and guidelines were announced in november 2011. according to those new harp 2.0 guidelines, the automated mortgage systems, desk underwriter and loan prospect, must update their underwriting systems by march 2012. until then, loans can be underwritten manually, but experts expect many lenders will prefer to wait for the automated approval system, as it reduces the lenders’ risks.

start shopping

shop around with different lenders and brokers to find the loan that best suits your needs. go to the bills.com mortgage saving center for no-cost, pre-screened quotes from mortgage lenders.

best,

bill